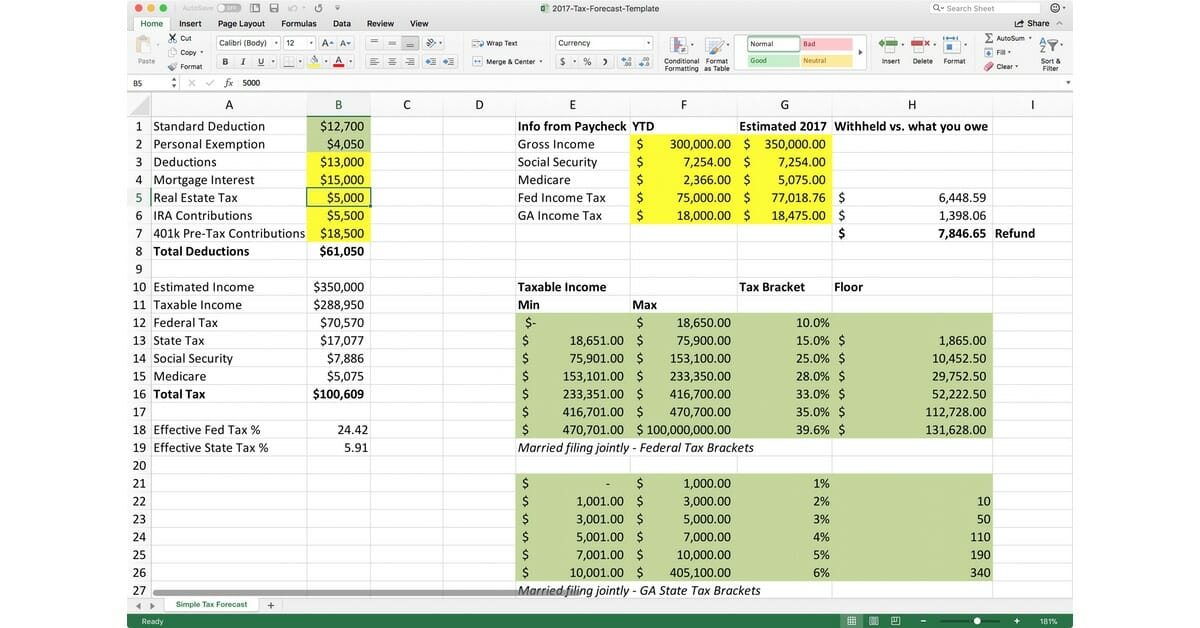

2025 Tax Sheet - This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension. Long term capital gains thresholds for individuals. Net investment income tax & medicare tax. Estimated tax is the method used to pay tax on income that isn’t. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Ordinary income tax brackets for individuals. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which.

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Estimated tax is the method used to pay tax on income that isn’t. Net investment income tax & medicare tax. Ordinary income tax brackets for individuals. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension. Long term capital gains thresholds for individuals.

Long term capital gains thresholds for individuals. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Ordinary income tax brackets for individuals. Net investment income tax & medicare tax. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Estimated tax is the method used to pay tax on income that isn’t. Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension.

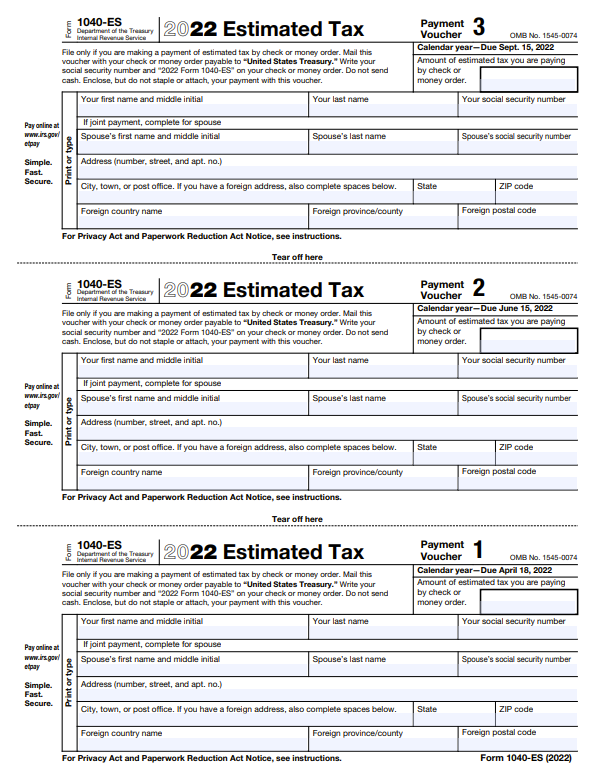

Estimated Tax Payment Calculator 2025 Kevin E. Anderson

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Ordinary income tax brackets for individuals. Estimated tax is the method used to pay tax on income that.

W9 Tax Form 2025 Pdf William N. Hughes

Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Estimated tax is the method used to pay tax on income that isn’t. Ordinary income tax brackets for individuals. Federal income tax return deadline for the business that maintains such plans is april 15, 2025,.

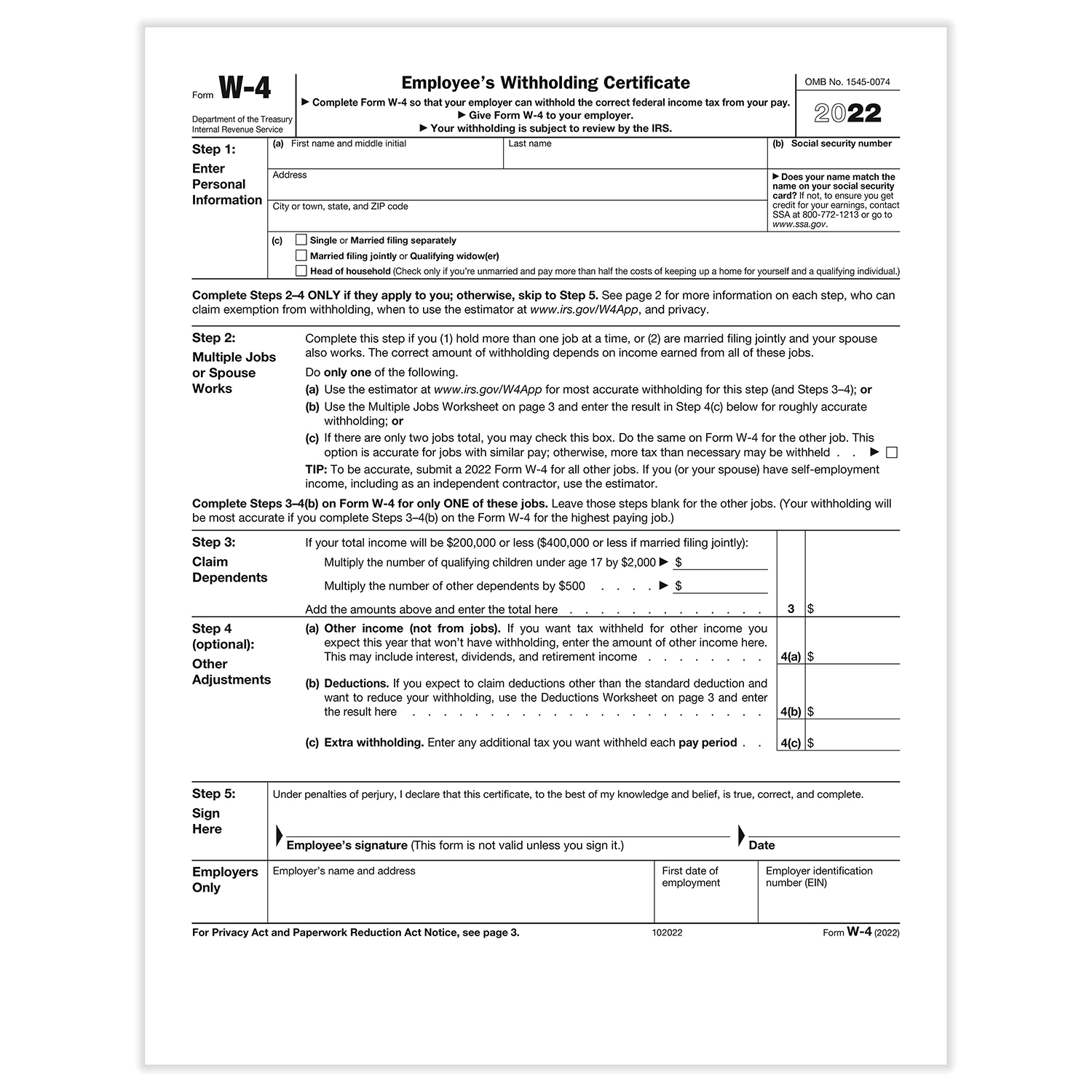

Printable 2025 W4 Dennis Williams

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Ordinary income tax brackets for individuals. Net investment income tax & medicare tax. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if.

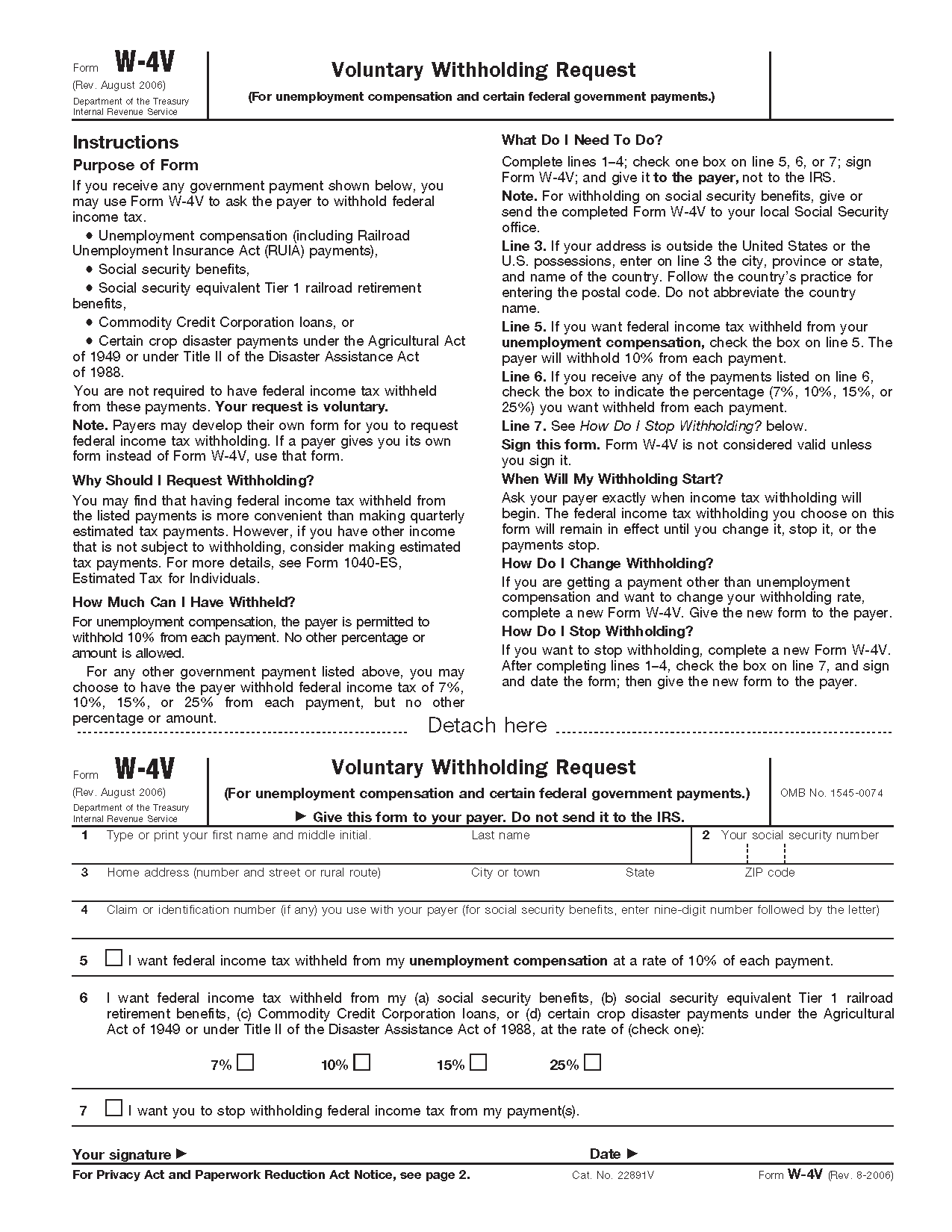

2025 Tax Forms 2025 Printable Coloring Alyssa O. McGillivray

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Net investment income tax & medicare tax. Estimated tax is the.

Ny Tax 2025 Jesse L. McCorkindale

Estimated tax is the method used to pay tax on income that isn’t. Long term capital gains thresholds for individuals. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Federal income tax return deadline for the business that maintains such plans is april 15,.

2025 2025 Estimated Tax Form Instructions Evan Terry

Net investment income tax & medicare tax. Long term capital gains thresholds for individuals. Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension. Estimated tax is the method used to pay tax on income that isn’t. Individual taxpayers are liable for a 3.8% net investment income tax.

W4 2025 Printable Form Irs Alice J. Molvig

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Ordinary income tax brackets for individuals. This quick reference guide provides.

W4 Tax Form 2025 Pdf Amina Pearl

Estimated tax is the method used to pay tax on income that isn’t. Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension. Long term capital gains thresholds for individuals. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025..

W4 Tax Form 2025 Printable Paul T. Oliveri

Estimated tax is the method used to pay tax on income that isn’t. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Ordinary income tax brackets for individuals. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if.

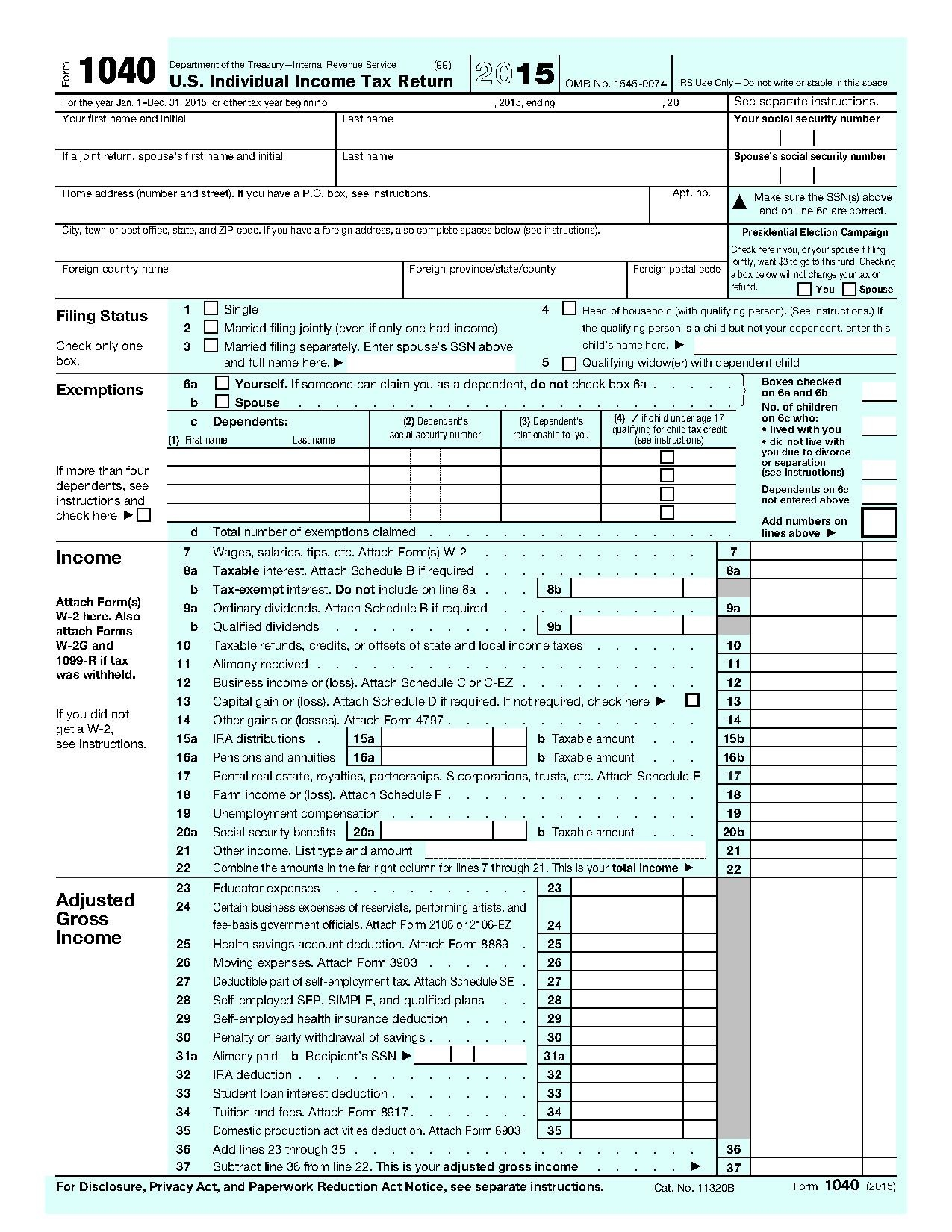

2025 Irs 1040 Form Malthe M. Christoffersen

Ordinary income tax brackets for individuals. Long term capital gains thresholds for individuals. Estimated tax is the method used to pay tax on income that isn’t. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure. Net investment income tax & medicare tax.

Individual Taxpayers Are Liable For A 3.8% Net Investment Income Tax On The Lesser Of Their Net Investment Income, Or The Amount By Which.

Federal income tax return deadline for the business that maintains such plans is april 15, 2025, and federal income tax return extension. Estimated tax is the method used to pay tax on income that isn’t. Net investment income tax & medicare tax. Ordinary income tax brackets for individuals.

This Quick Reference Guide Provides Tax Brackets And Key Deductions, Credits, And Retirement Plan Contribution Limits For 2025.

Long term capital gains thresholds for individuals. Use this worksheet to figure the amount of your projected withholding for 2025, compare it to your projected tax for 2025, and, if necessary, figure.