Accrued Expenses In Balance Sheet - Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

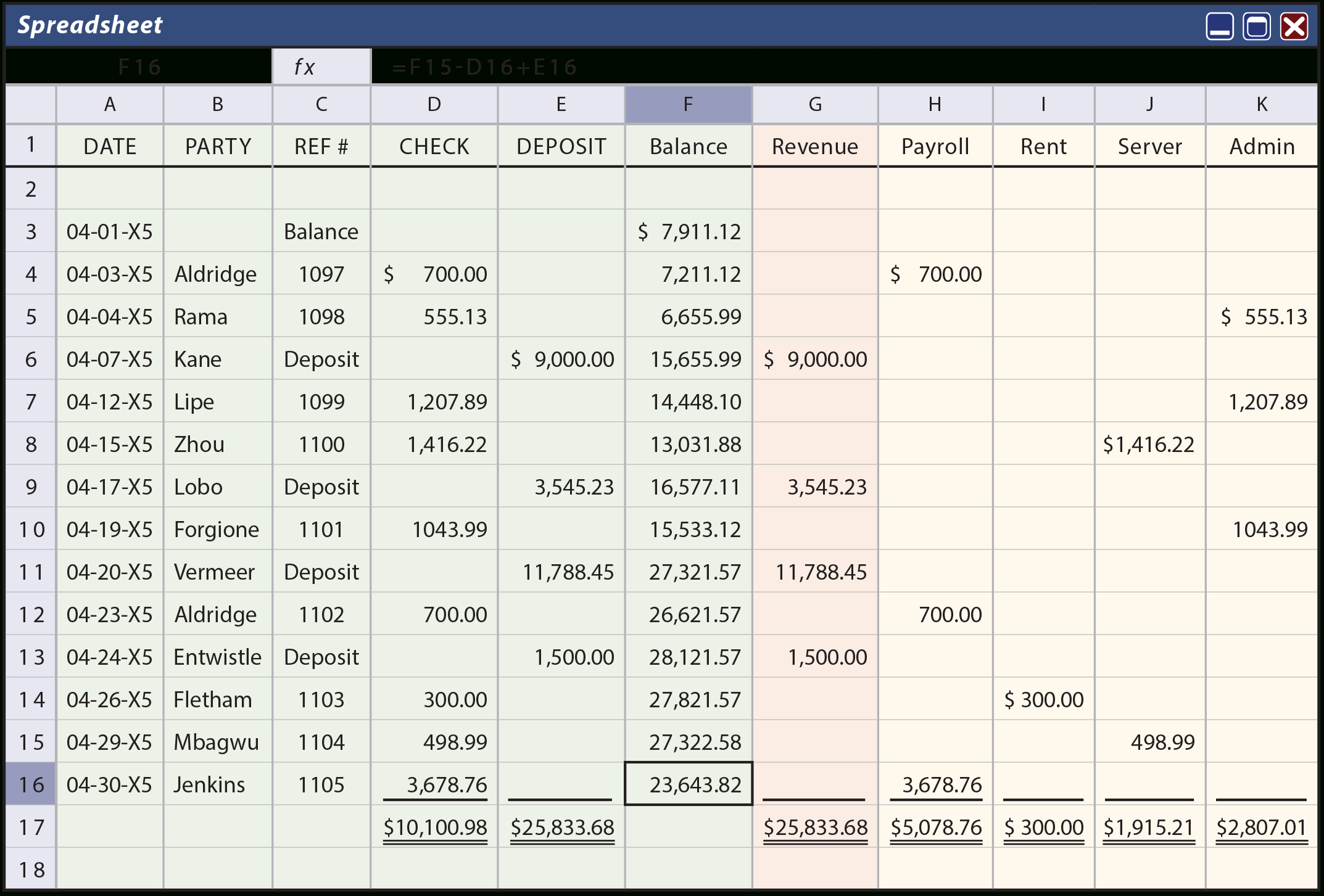

Expense Accrual Spreadsheet Template —

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.

Accrued Expense ⋆ Accounting Services

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

Accrued Expense Examples of Accrued Expenses

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

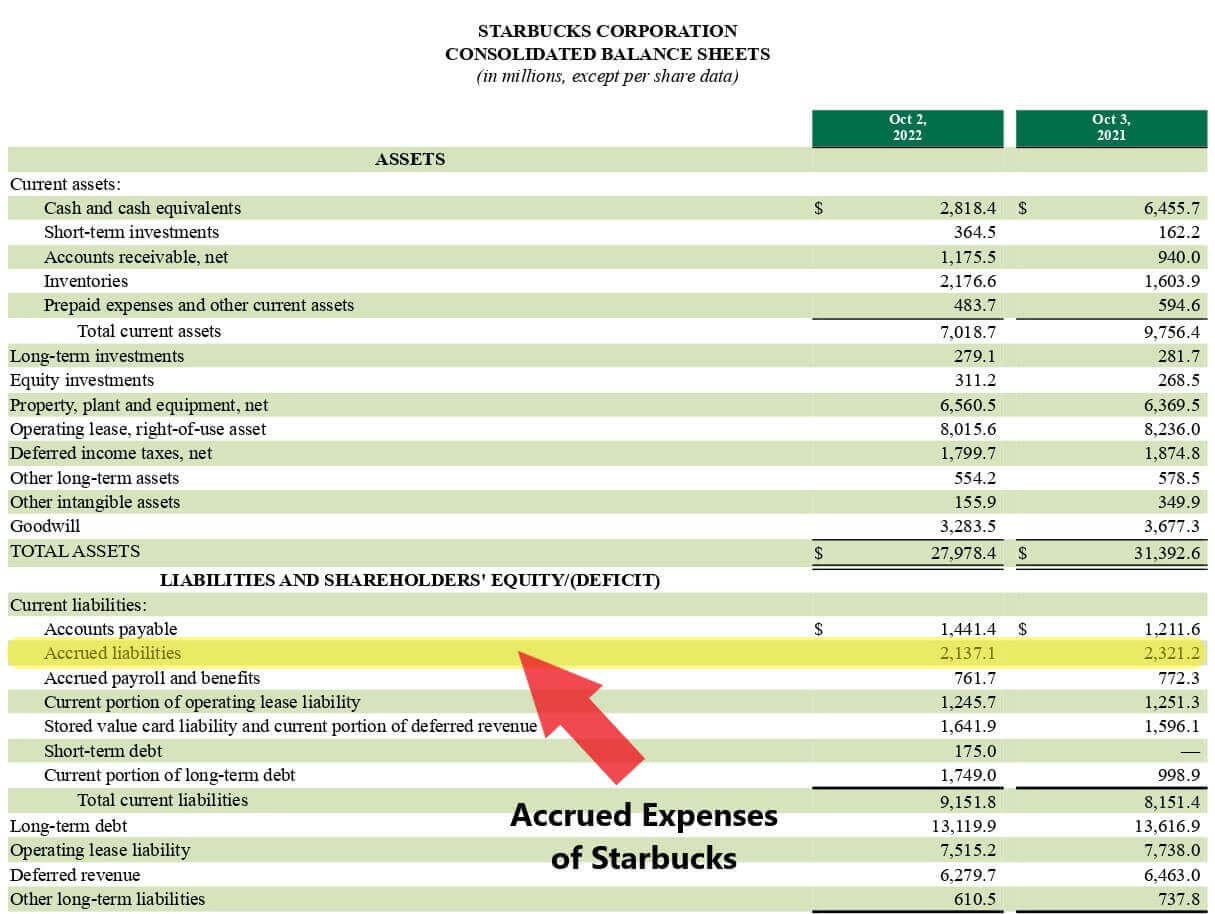

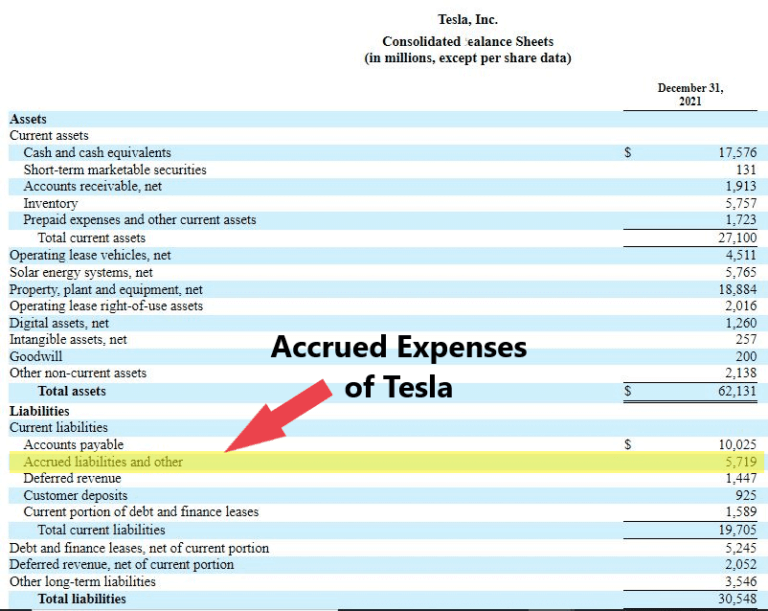

Accrued Liability

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.

Is accrued receivable debit or credit? Leia aqui Is accrued receivable

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.

Accrued Expense Examples of Accrued Expenses

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

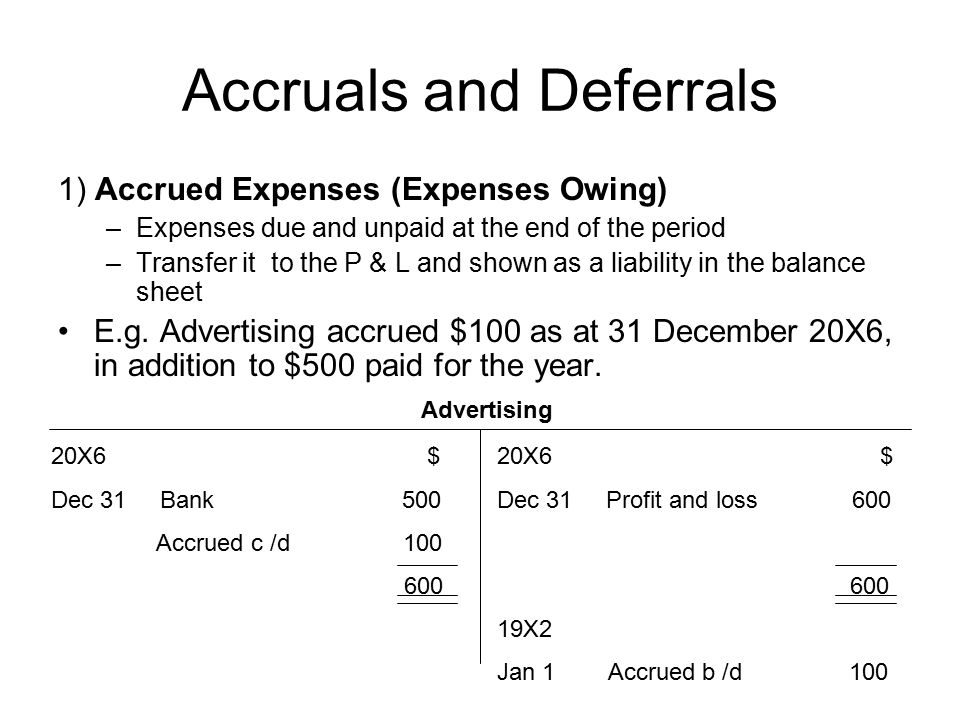

The accrual basis of accounting Business Accounting

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

Accrued Expense Meaning, Accounting Treatment And More

Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

rebranding costs accounting treatment

Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes.

Accrued Expense Definition And Accounting Process vrogue.co

You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably. Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. Sometimes, businesses have not yet paid or earned money but already have income and expenditures in their balance sheets.

Sometimes, Businesses Have Not Yet Paid Or Earned Money But Already Have Income And Expenditures In Their Balance Sheets.

Accrued expenses are expenses that have been incurred but not paid or recorded, such as interest, salaries, and taxes. You record an accrued expense when you have incurred the expense but have not yet recorded a supplier invoice (probably.