Are Unearned Revenues Reported On A Balance Sheet - Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or.

Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company.

It is classified as a liability because the company. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is reported on the balance sheet, not the income statement.

Unearned Revenue Definition, How To Record, Example

Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or.

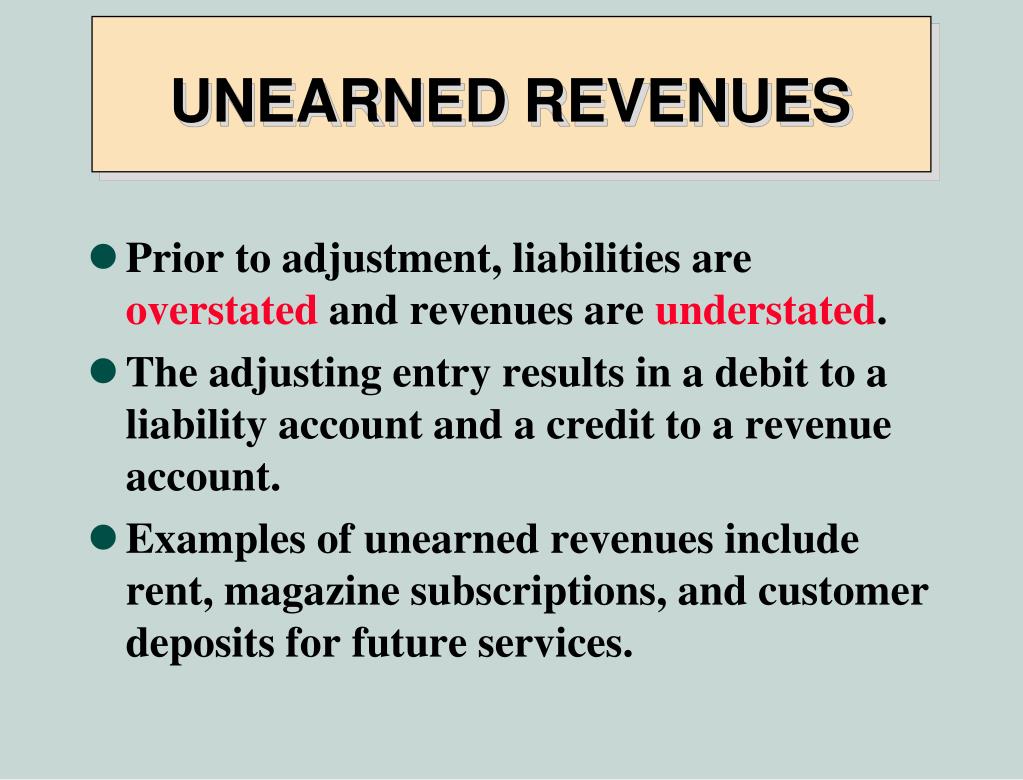

PPT Adjusting Entries Prepayments PowerPoint Presentation, free

It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered.

Unearned Revenue Definition

Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or.

What Is Unearned Revenue? QuickBooks Global

Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. It is classified as a liability because the company.

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Professional

Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

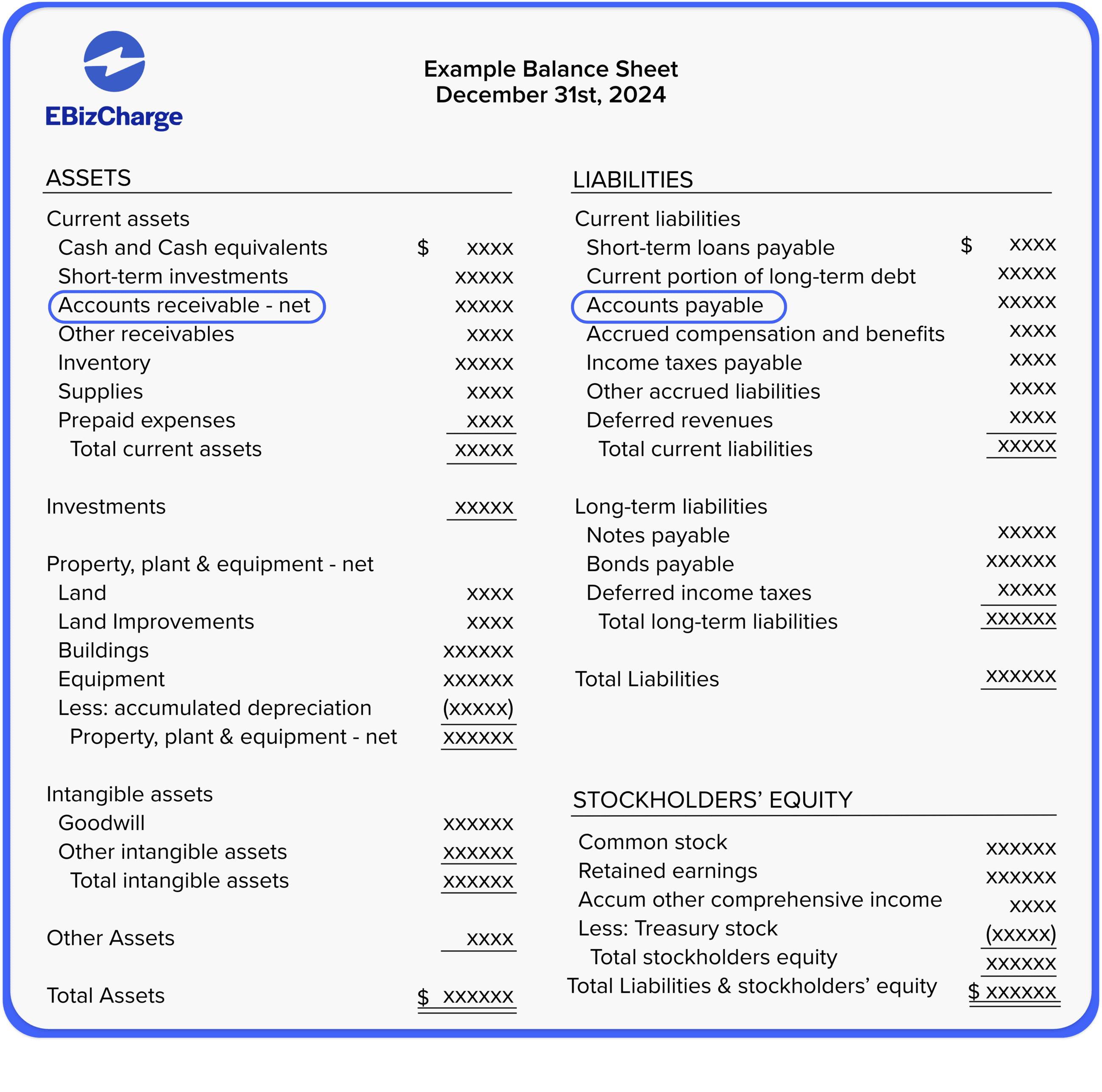

What are Accounts Receivable and Accounts Payable?

Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company.

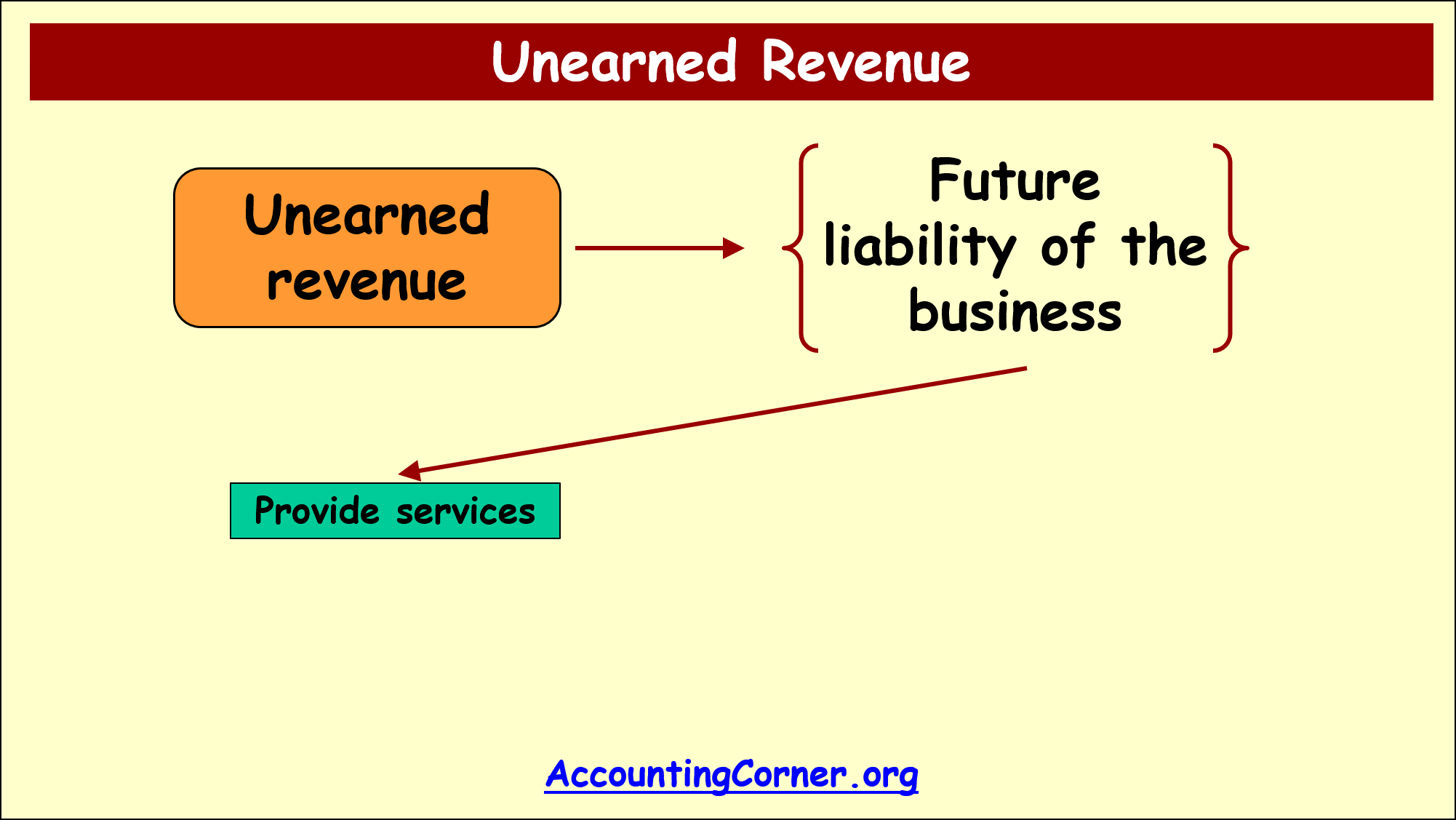

Unearned Revenue Accounting Corner

It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered.

[SOLVED] Following is the unadjusted trial balance for Course Eagle

Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. It is classified as a liability because the company. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is reported on the balance sheet, not the income statement.

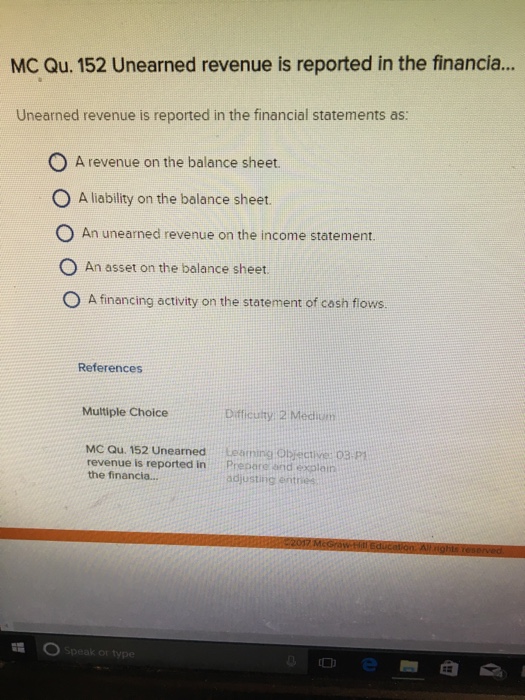

Solved Unearned revenue is reported in the financial

It is classified as a liability because the company. Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is reported on the balance sheet, not the income statement. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or.

What Is Unearned Revenue? QuickBooks Global

Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. Unearned revenue is classified as a liability on the balance sheet, representing the company’s obligation to deliver goods or. It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

Unearned Revenue Is Classified As A Liability On The Balance Sheet, Representing The Company’s Obligation To Deliver Goods Or.

Unearned revenue appears as a liability on the balance sheet until the associated goods or services are delivered. It is classified as a liability because the company. Unearned revenue is reported on the balance sheet, not the income statement.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

![[SOLVED] Following is the unadjusted trial balance for Course Eagle](http://courseeagle.com/images/following-is-the-unadjusted-trial-balance-for-alonzo-institute-as-of-december-83165-1.jpg)