Cash On A Balance Sheet - Such asset classes include cash and cash equivalents, accounts receivable, and inventory. Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Cash is reported in the. Cash on a balance sheet includes currency, bank accounts and undeposited checks. Balance sheets are useful tools for individual and institutional investors, as well as. It is necessary to keep some cash available in case of unforeseen expenses. They mainly include a couple of support,. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

Cash on a balance sheet includes currency, bank accounts and undeposited checks. Cash is reported in the. Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Balance sheets are useful tools for individual and institutional investors, as well as. They mainly include a couple of support,. It is necessary to keep some cash available in case of unforeseen expenses. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. The most liquid of all assets, cash, appears on the first line of the balance sheet. Such asset classes include cash and cash equivalents, accounts receivable, and inventory.

Balance sheets are useful tools for individual and institutional investors, as well as. It is necessary to keep some cash available in case of unforeseen expenses. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. They mainly include a couple of support,. Such asset classes include cash and cash equivalents, accounts receivable, and inventory. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash on a balance sheet includes currency, bank accounts and undeposited checks. Cash is reported in the. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Current assets have a lifespan of one year or less, meaning they can be converted easily into cash.

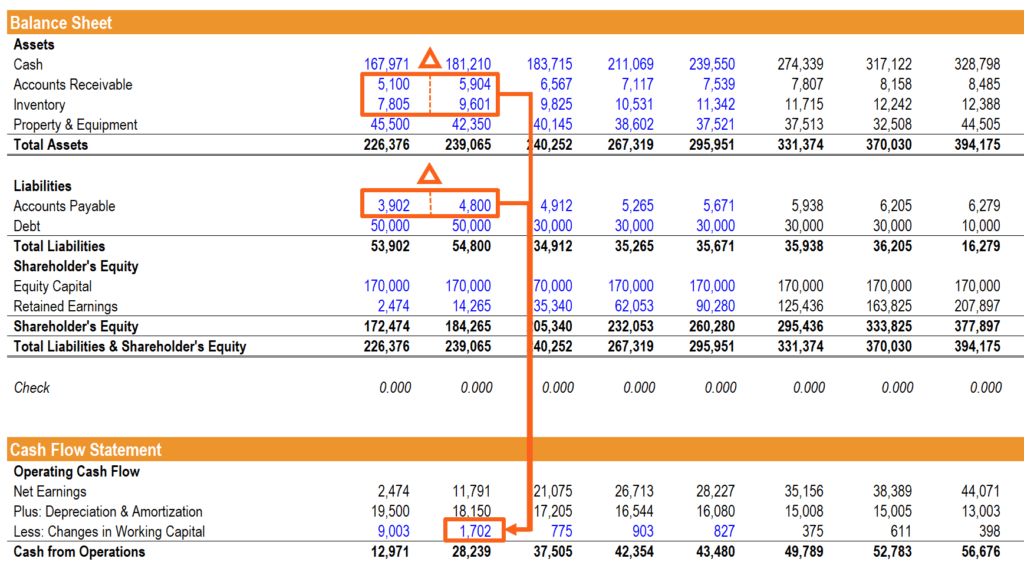

How the 3 Financial Statements are Linked Together Step by Step

Cash is reported in the. Cash on a balance sheet includes currency, bank accounts and undeposited checks. Such asset classes include cash and cash equivalents, accounts receivable, and inventory. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. It is necessary to keep some cash.

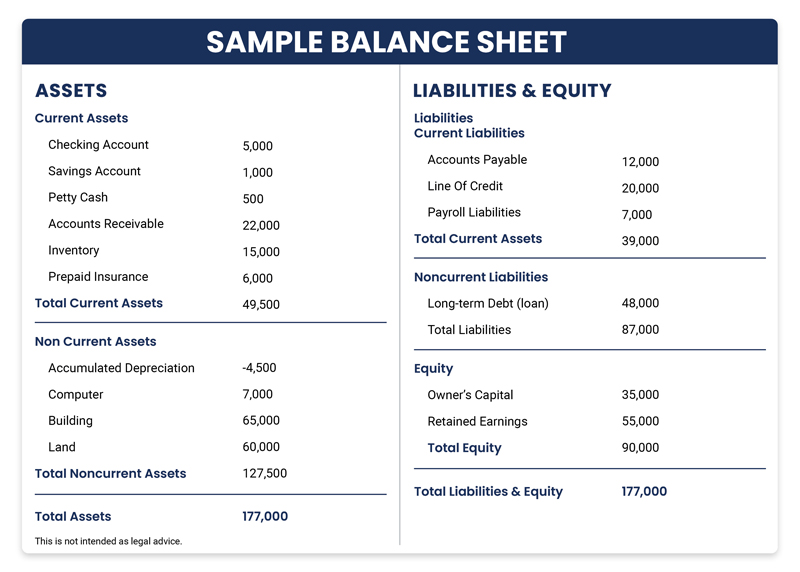

Essentials of a Balance Sheet Key Points You Must Know

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Cash is reported in the..

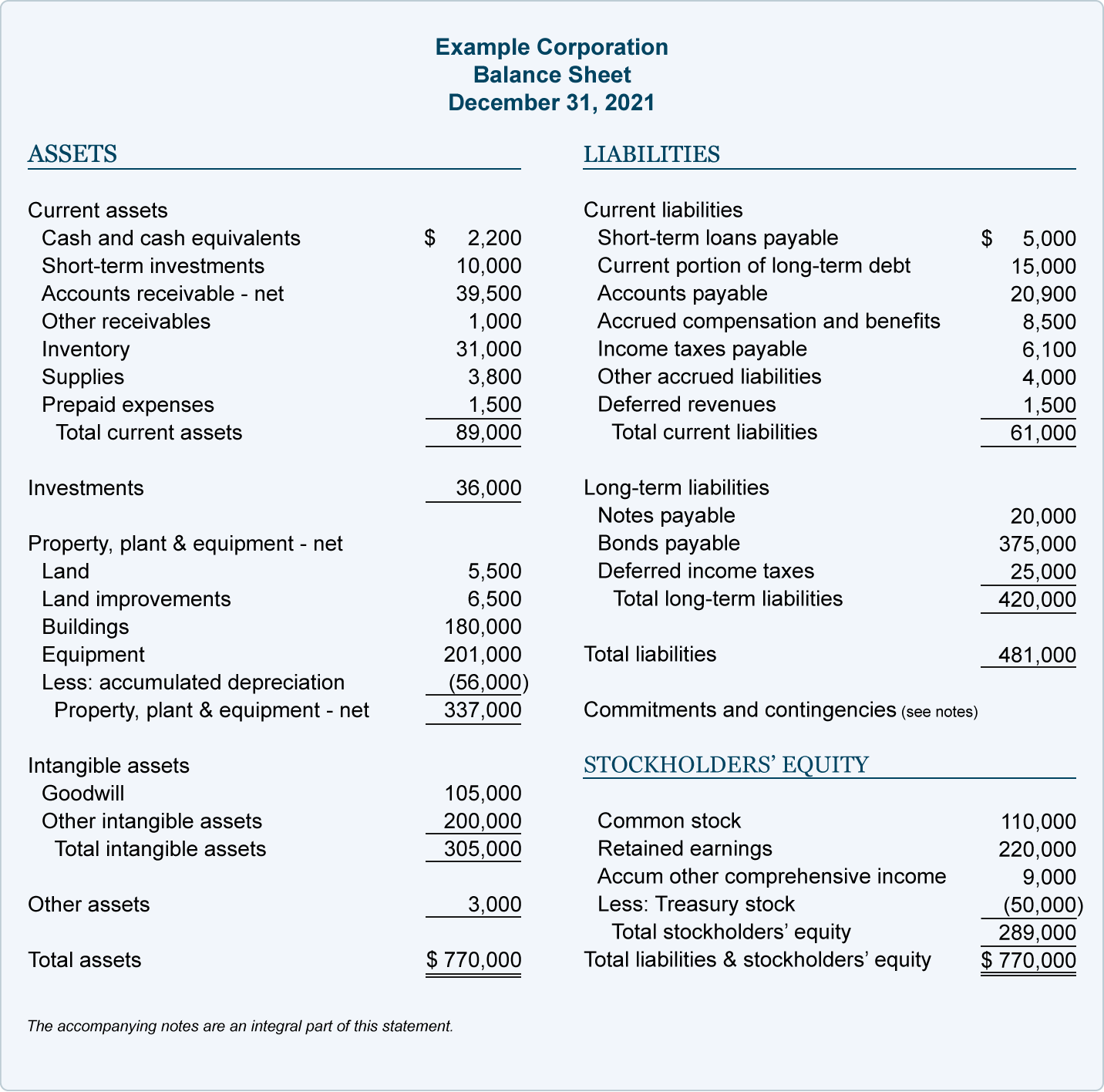

What Is a Financial Statement? Detailed Overview of Main Statements

They mainly include a couple of support,. It is necessary to keep some cash available in case of unforeseen expenses. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. Balance sheets are.

Cashier Balance Sheet Template Excel Templates

Balance sheets are useful tools for individual and institutional investors, as well as. They mainly include a couple of support,. The most liquid of all assets, cash, appears on the first line of the balance sheet. Cash is reported in the. It is necessary to keep some cash available in case of unforeseen expenses.

How to Read & Prepare a Balance Sheet QuickBooks

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. Cash on a balance sheet includes currency, bank accounts and undeposited checks. Cash is reported in the. The most liquid of all assets,.

How To Create Balance Sheets, Cash Flow & Better Business Decisions

Cash on a balance sheet includes currency, bank accounts and undeposited checks. The most liquid of all assets, cash, appears on the first line of the balance sheet. They mainly include a couple of support,. It is necessary to keep some cash available in case of unforeseen expenses. Measuring a company’s net worth, a balance sheet shows what a company.

Basic Finance 101 Balance Sheet, Cash Flow and Operations

Such asset classes include cash and cash equivalents, accounts receivable, and inventory. Cash is reported in the. It is necessary to keep some cash available in case of unforeseen expenses. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash.

Sample Balance Sheet Template Excel

Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. They mainly include a couple of support,. Balance sheets are useful tools for individual and institutional investors, as well as. It is necessary to keep some cash available in case of unforeseen expenses. Cash on a balance sheet includes currency, bank accounts.

Where’s the cash? Check your Balance Sheet CFO.University

Cash is reported in the. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or.

What Is a Financial Statement? Detailed Overview of Main Statements

Such asset classes include cash and cash equivalents, accounts receivable, and inventory. It is necessary to keep some cash available in case of unforeseen expenses. Cash on a balance sheet includes currency, bank accounts and undeposited checks. Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets.

Cash On A Balance Sheet Includes Currency, Bank Accounts And Undeposited Checks.

Cash is reported in the. Balance sheets are useful tools for individual and institutional investors, as well as. Such asset classes include cash and cash equivalents, accounts receivable, and inventory. It is necessary to keep some cash available in case of unforeseen expenses.

They Mainly Include A Couple Of Support,.

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. The most liquid of all assets, cash, appears on the first line of the balance sheet. Current assets have a lifespan of one year or less, meaning they can be converted easily into cash. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.