Deferred Revenue Balance Sheet - Current liabilities are expected to be repaid within one year unlike long term liabilities which are. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. You record deferred revenue as a short term or current liability on the balance sheet. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Proper accounting for deferred revenue helps. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned.

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. You record deferred revenue as a short term or current liability on the balance sheet. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Proper accounting for deferred revenue helps. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. You record deferred revenue as a short term or current liability on the balance sheet. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Proper accounting for deferred revenue helps.

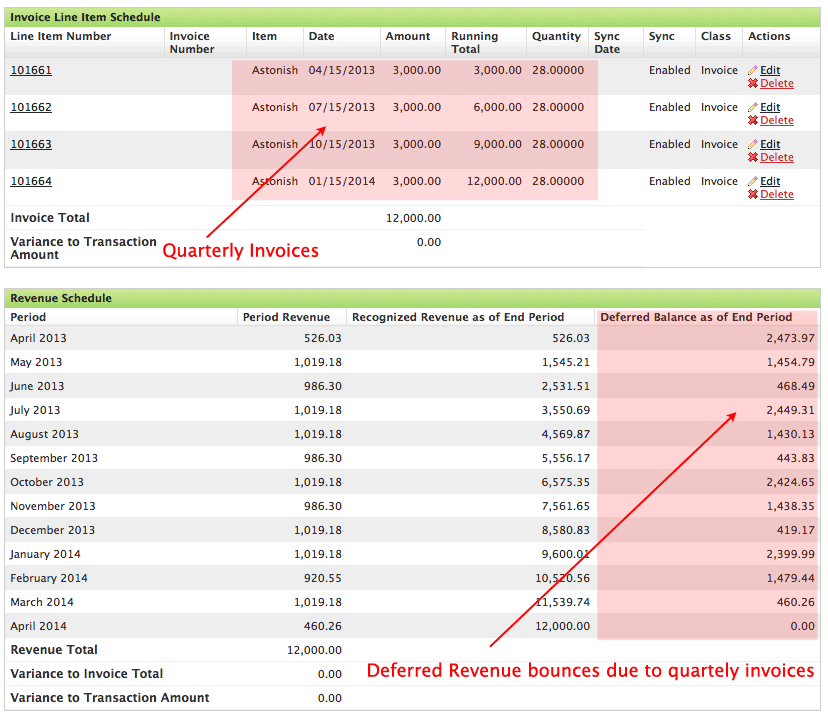

What is Deferred Revenue in a SaaS Business? SaaSOptics

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Deferred revenue is recorded as a liability on the balance sheet, since the company.

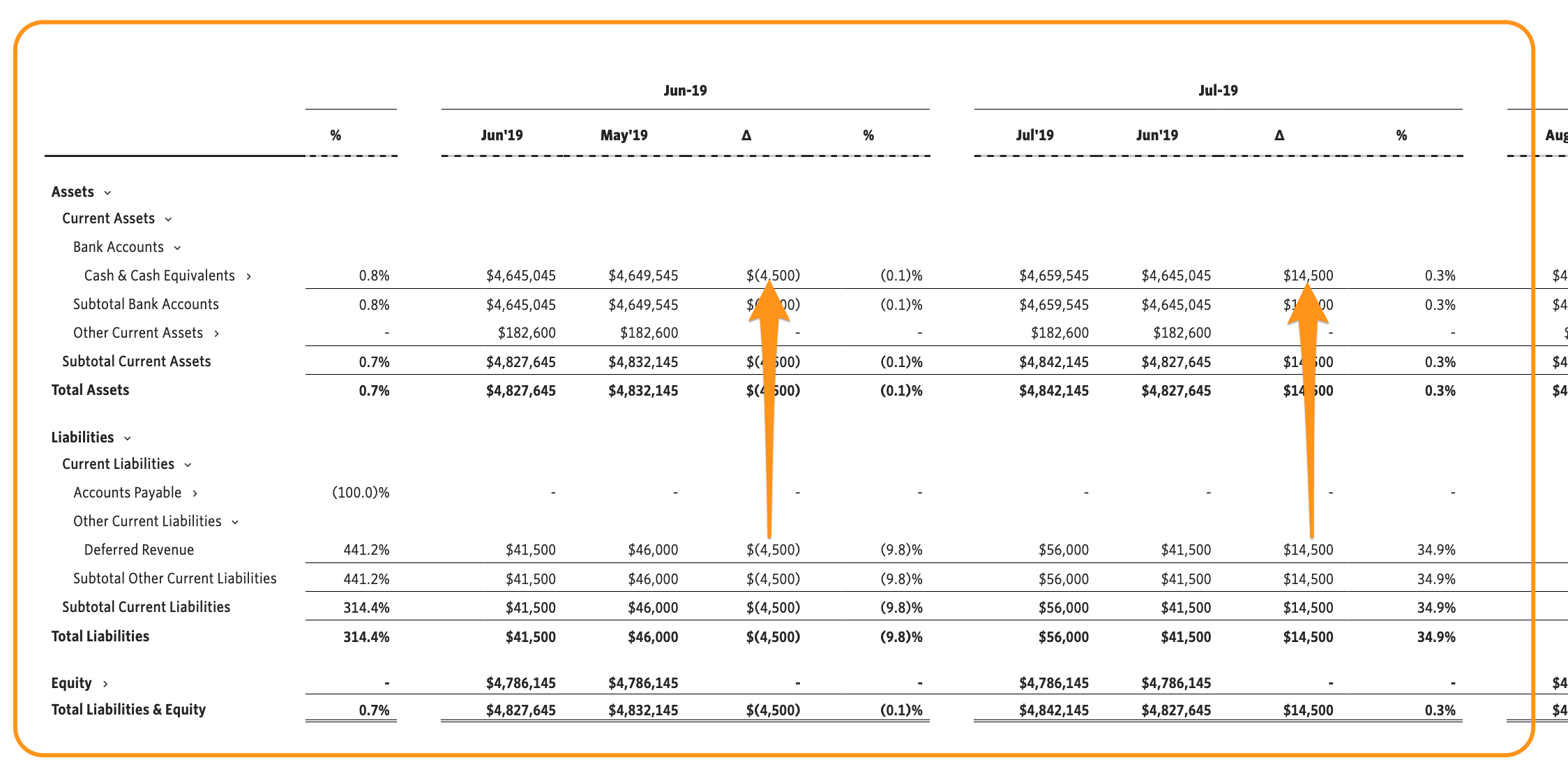

Simple Deferred Revenue with Jirav Pro

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. You record deferred revenue as a short term or current liability on the.

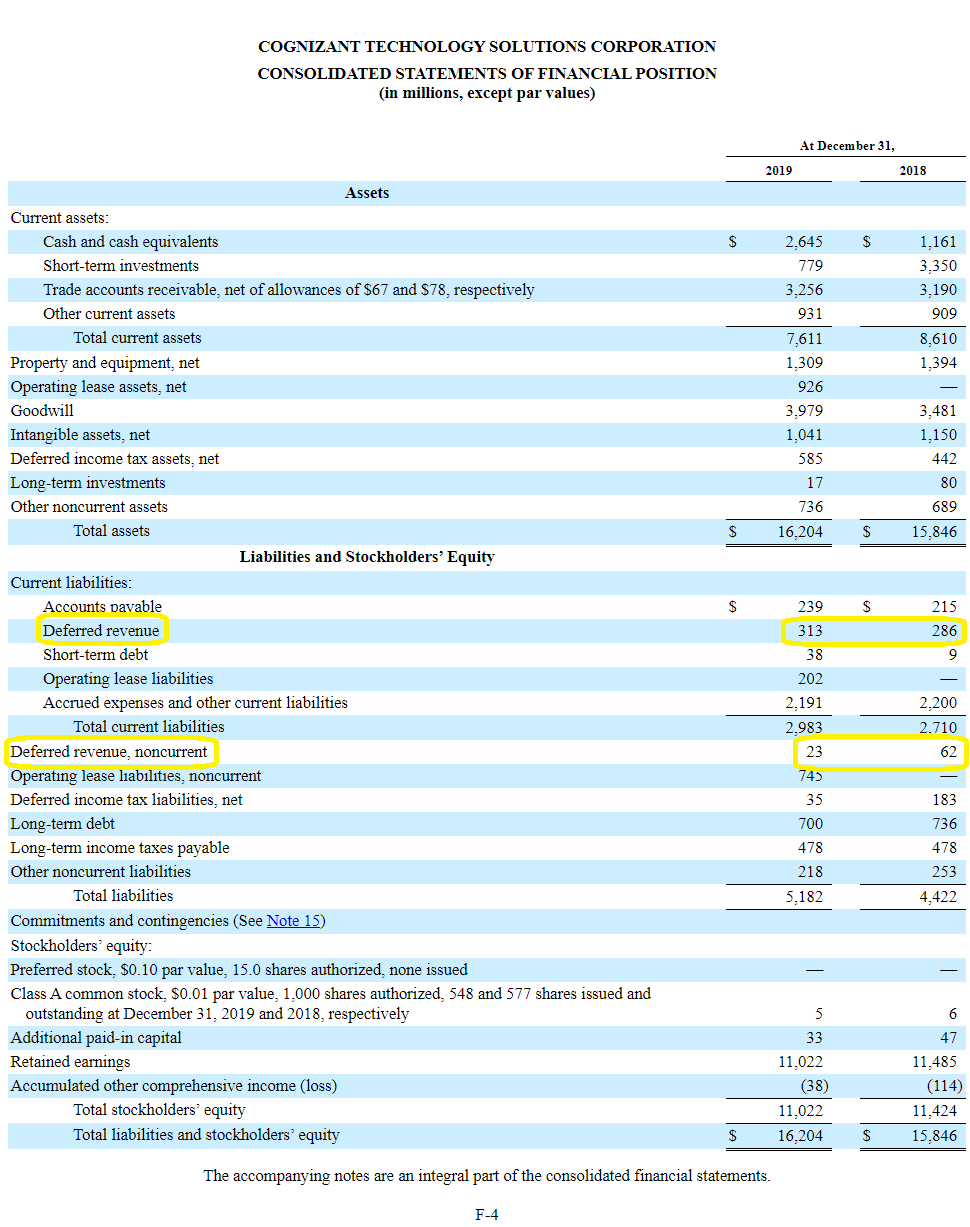

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. You record deferred revenue as a short term or.

41 Balance Sheet Deferred Tax Expense

Current liabilities are expected to be repaid within one year unlike long term liabilities which are. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is recorded as a liability on the balance sheet, since the.

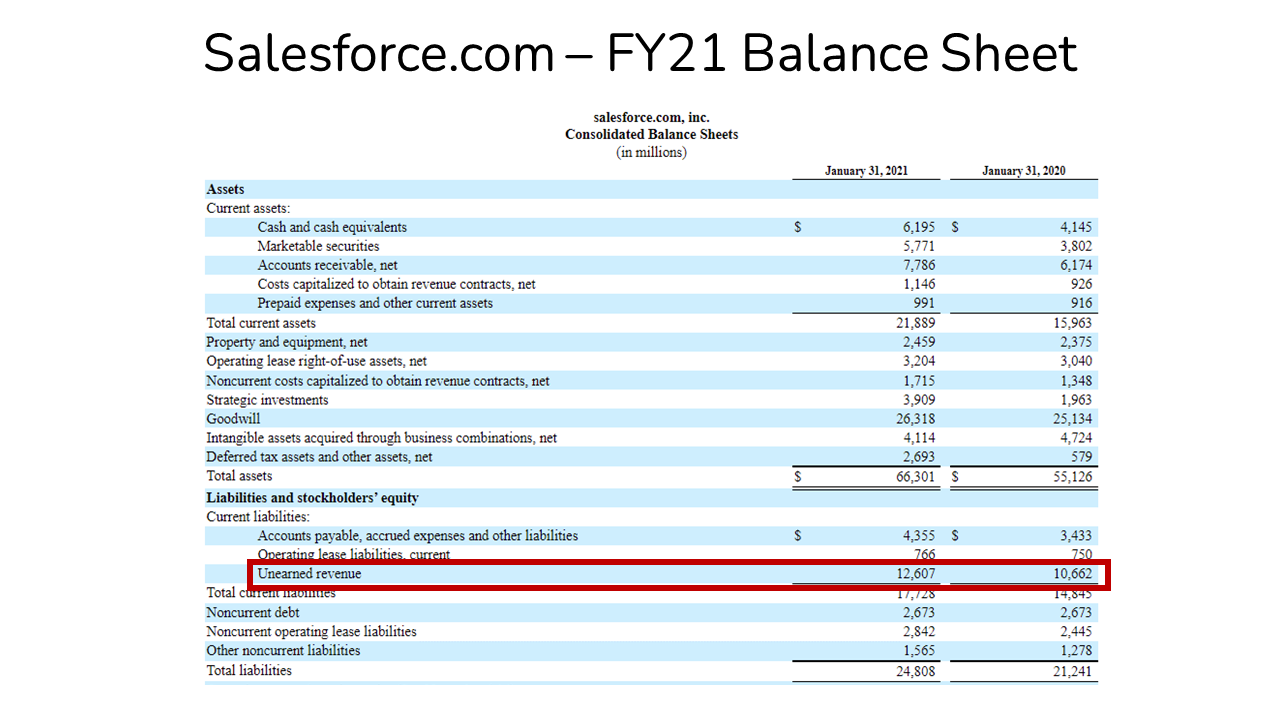

What is Deferred Revenue? The Ultimate Guide (2022)

Proper accounting for deferred revenue helps. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income..

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until the product or service is delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Current.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue (also called unearned revenue).

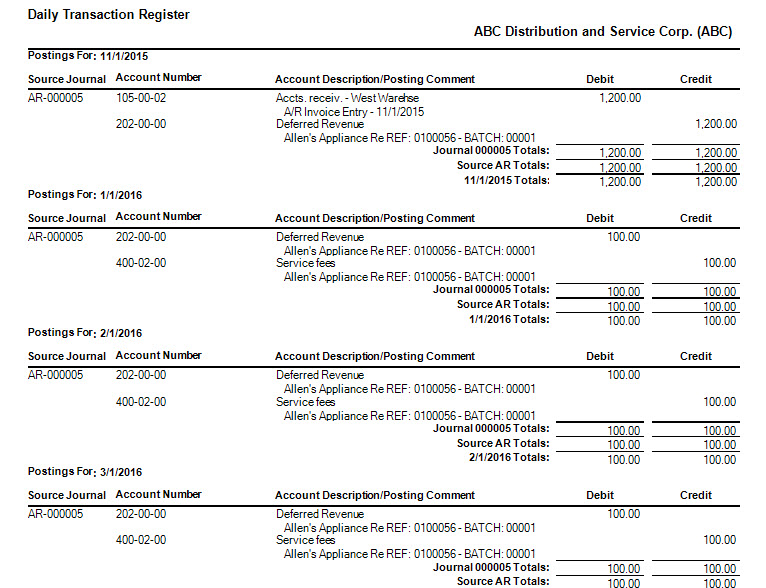

Sage 100 Accounts Receivable Deferred Revenue Posting

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the.

Deferred Revenue Balance Sheet Ppt Powerpoint Presentation Visual Aids

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. Current liabilities are expected to be repaid within one year unlike long term liabilities.

Deferred Tax Liabilities Explained (with RealLife Example in a

Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned. You record deferred revenue as a short term or current liability on the balance sheet. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance.

Deferred Revenue Is Recorded As A Liability On The Balance Sheet, Since The Company Has An Unmet Obligation To The Customer Until The Product Or Service Is Delivered.

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or. Current liabilities are expected to be repaid within one year unlike long term liabilities which are. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income. Deferred revenue is an advance payment received for goods or services to be delivered in the future, recorded as a liability until earned.

You Record Deferred Revenue As A Short Term Or Current Liability On The Balance Sheet.

Proper accounting for deferred revenue helps.