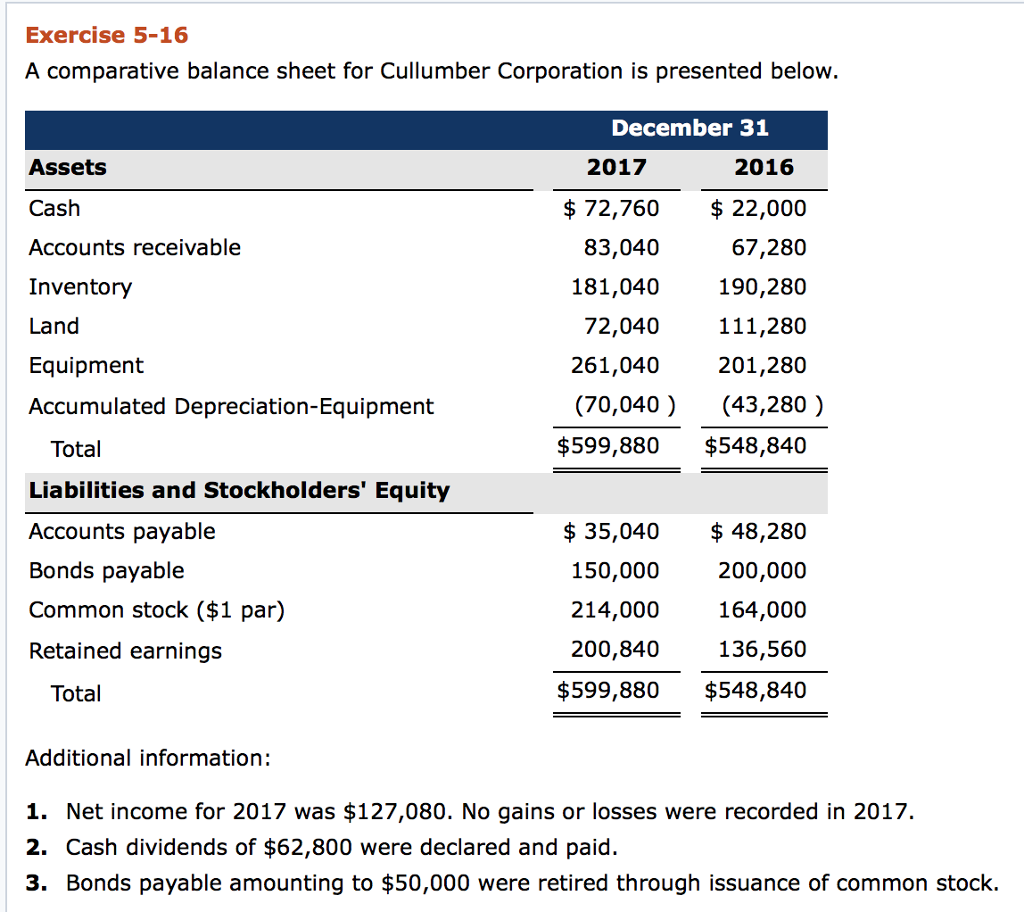

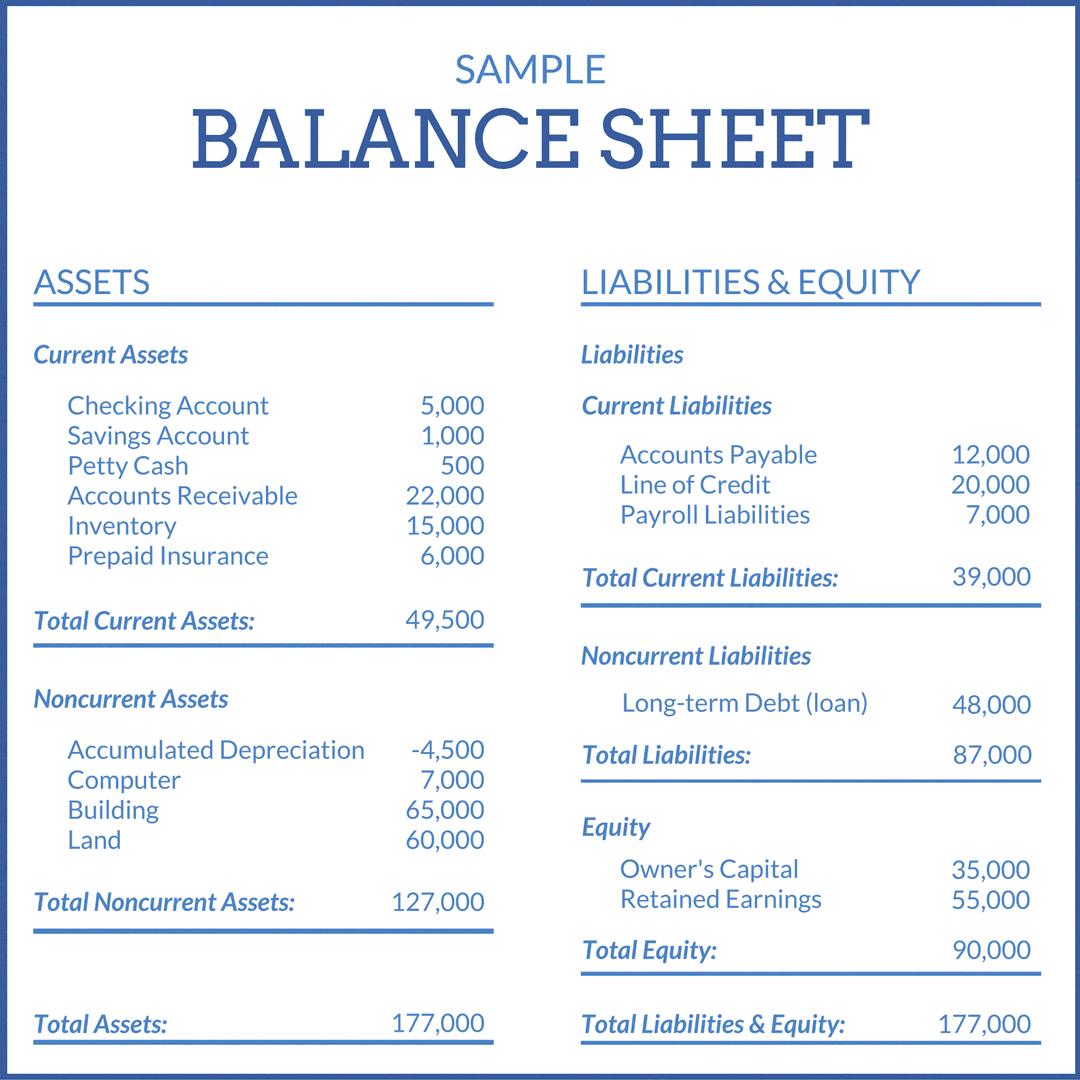

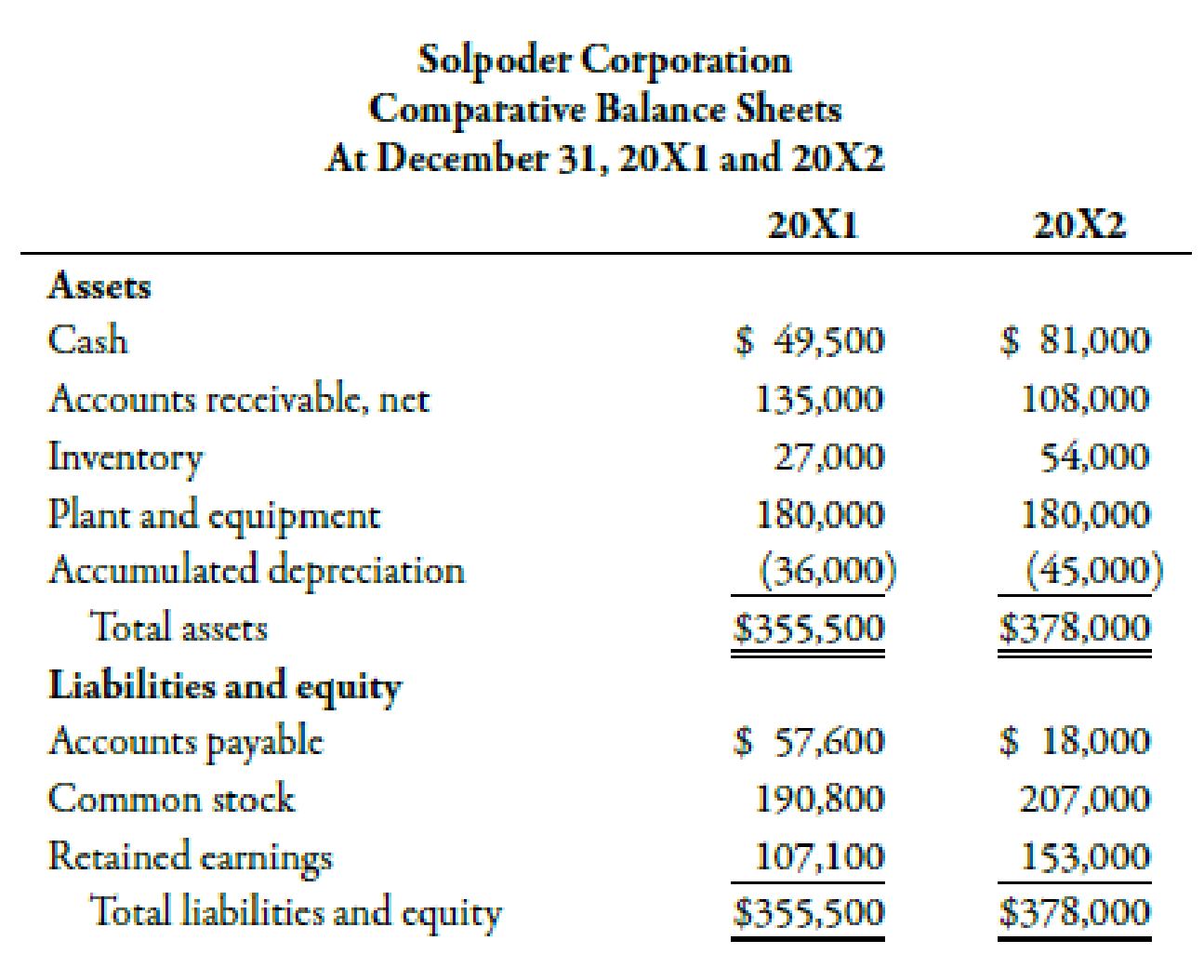

Dividends Payable On Balance Sheet - Paying the dividends reduces the amount of retained earnings stated in the. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. As a result, the balance sheet size is reduced. Unpaid declared dividends other than. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Before dividends are paid, there is no impact on the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. Dividends in the balance sheet. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance.

Dividends in the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. Before dividends are paid, there is no impact on the balance sheet. Paying the dividends reduces the amount of retained earnings stated in the. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. Unpaid declared dividends other than. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. As a result, the balance sheet size is reduced.

When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. Before dividends are paid, there is no impact on the balance sheet. Dividends in the balance sheet. As a result, the balance sheet size is reduced. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Unpaid declared dividends other than. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Paying the dividends reduces the amount of retained earnings stated in the.

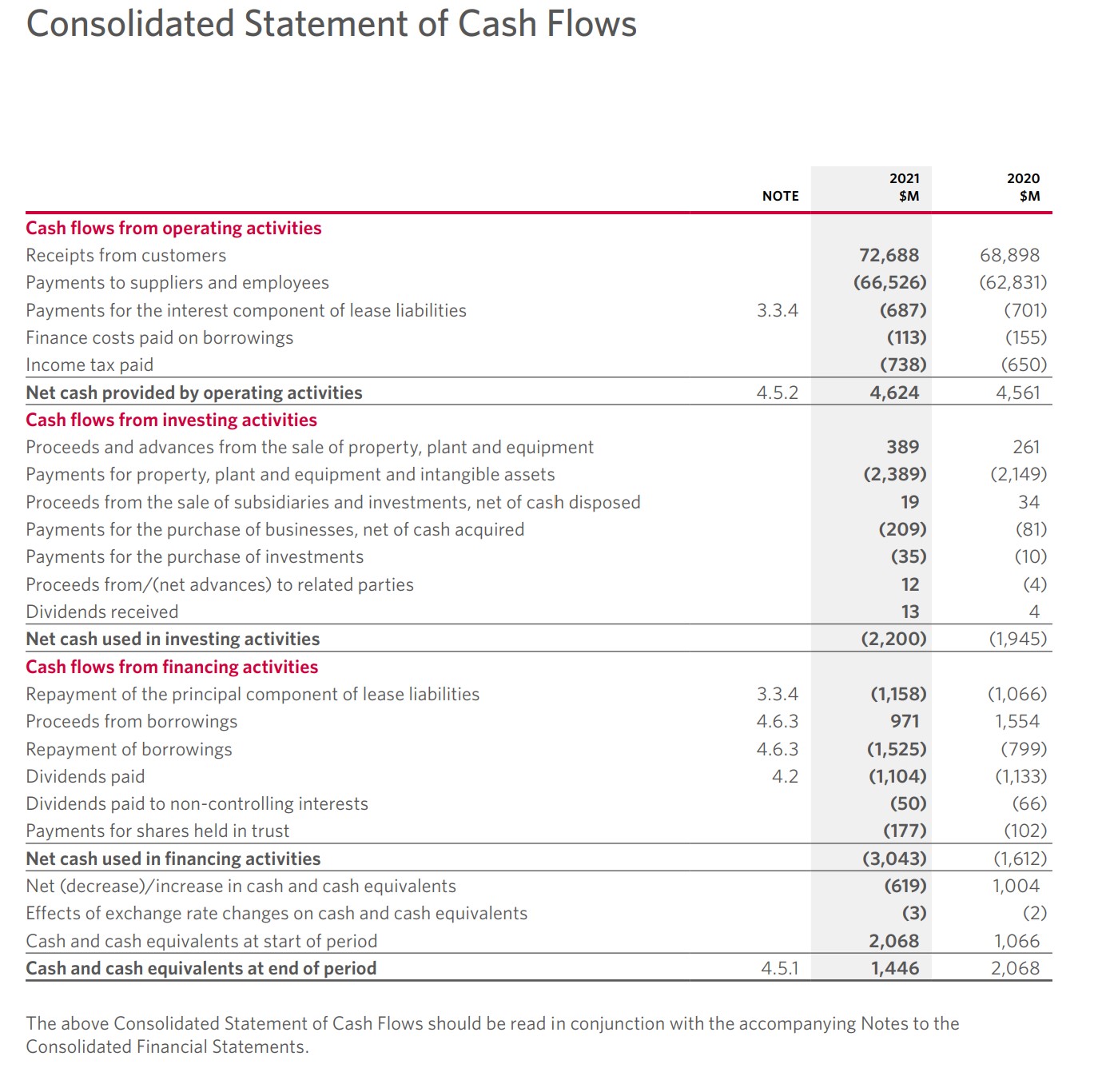

Balance Sheet Dividends

Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet. Unpaid declared dividends other than. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. When dividends are paid, the impact on the balance sheet is a decrease in the.

What The Balance Sheet Reveals on Dividends

When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Dividends in the balance sheet. Paying the dividends reduces the amount of retained earnings stated in.

Balance Sheet Dividends

Dividends in the balance sheet. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Reporting entities often declare dividends on common stock before.

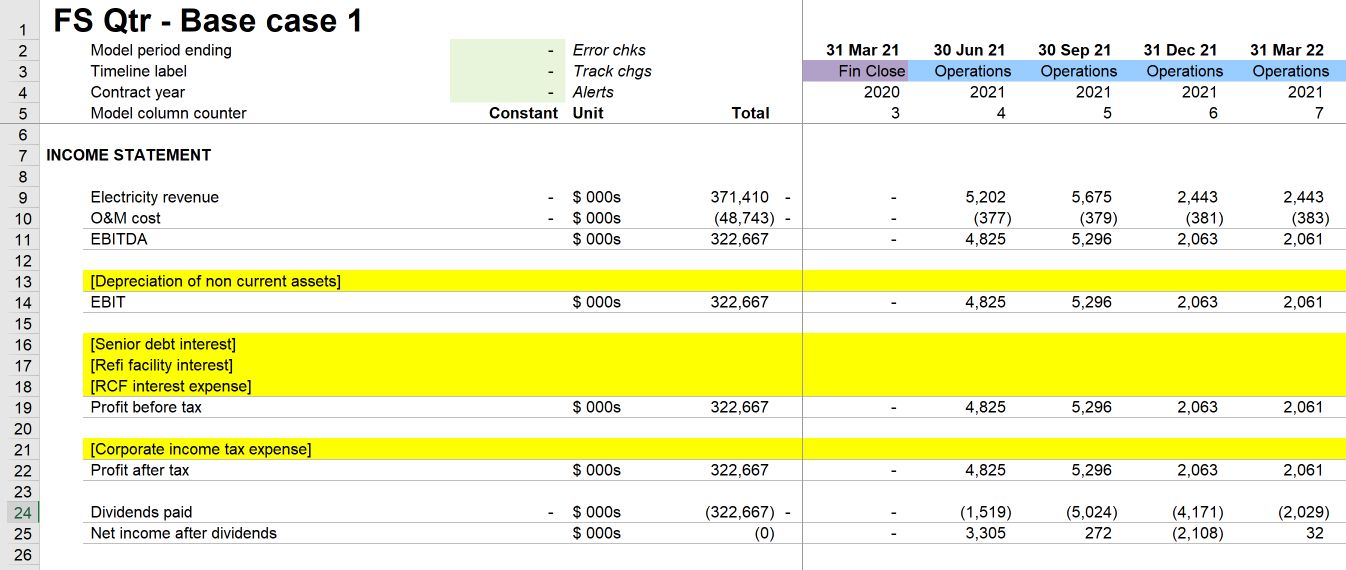

Dividends Payable Balance Sheet Ppt Powerpoint Presentation Slides

When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Unpaid declared dividends other than. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet date. Dividends in the balance sheet. Paying the dividends reduces the amount.

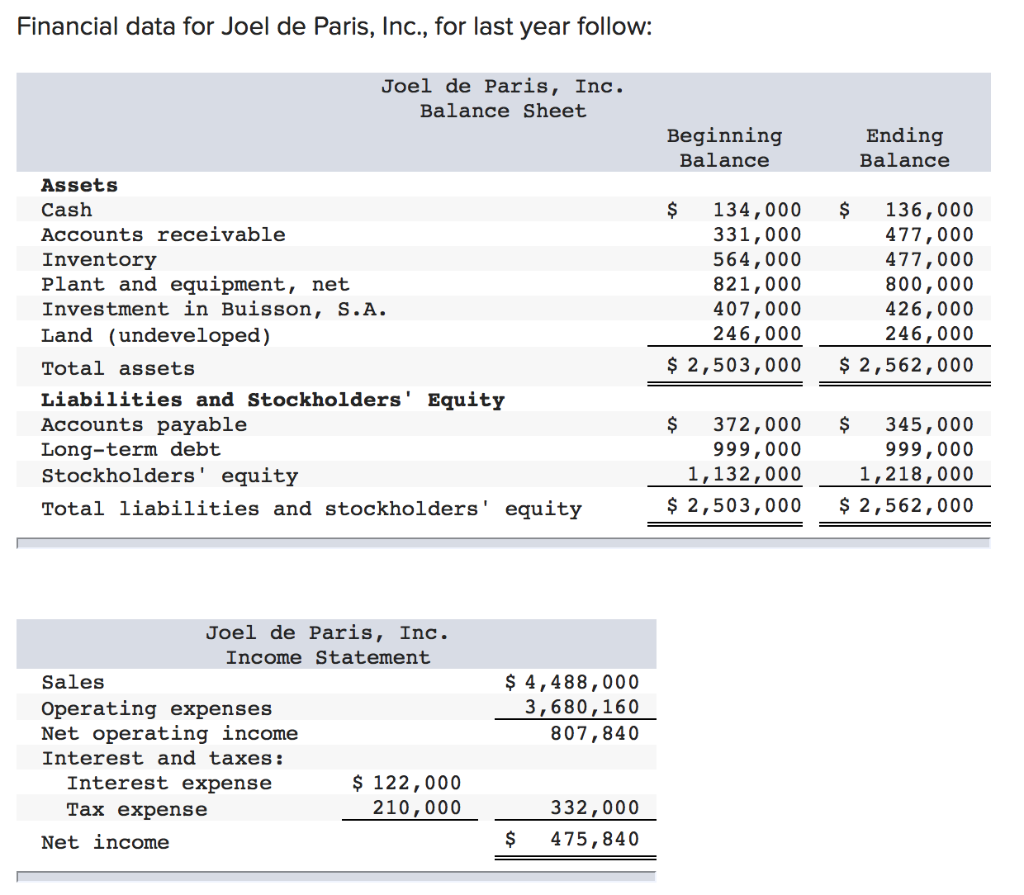

What Is A Dividend? The Complete Guide Oliver Elliot

Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. Paying the dividends reduces the amount of retained earnings stated in the. Reporting entities often.

Balance Sheet Dividends

Unpaid declared dividends other than. Paying the dividends reduces the amount of retained earnings stated in the. Dividends in the balance sheet. Before dividends are paid, there is no impact on the balance sheet. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance.

4.6 Cash and Share Dividends Accounting Business and Society

Before dividends are paid, there is no impact on the balance sheet. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Dividends in the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. As a.

Balance Sheet Example With Dividends sheet

As a result, the balance sheet size is reduced. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Unpaid declared dividends other than..

Balance Sheet Dividends

As a result, the balance sheet size is reduced. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Dividends in the balance sheet. Dividends payable is classified as a current liability on the balance sheet, since the expense represents declared payments to shareholders. When a company declares a.

Modeling dividends solution

Before dividends are paid, there is no impact on the balance sheet. Unpaid declared dividends other than. When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Reporting entities often declare dividends on common stock before the balance sheet date, and then pay the dividends after the balance sheet.

Dividends Payable Is Classified As A Current Liability On The Balance Sheet, Since The Expense Represents Declared Payments To Shareholders.

When dividends are paid, the impact on the balance sheet is a decrease in the company’s dividends payable and cash balance. Unpaid declared dividends other than. Dividends in the balance sheet. Paying the dividends reduces the amount of retained earnings stated in the.

Reporting Entities Often Declare Dividends On Common Stock Before The Balance Sheet Date, And Then Pay The Dividends After The Balance Sheet Date.

As a result, the balance sheet size is reduced. Before dividends are paid, there is no impact on the balance sheet. When a company declares a dividend to distribute to its shareholders, the dividends payable account is created on the liability side of the balance sheet.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)