How To Calculate Stock Price From Balance Sheet - Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. Current stock price × number of outstanding shares = market value of equity. You will need the corporation's total stockholder equity holdings. The number of shares outstanding is listed in the. You can learn how to find share price from balance sheets.

You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. Current stock price × number of outstanding shares = market value of equity. You will need the corporation's total stockholder equity holdings.

You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity.

Calculate Common Stock On Balance Sheet

Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. You can learn how to find share price from balance sheets. You will need the corporation's total stockholder equity holdings.

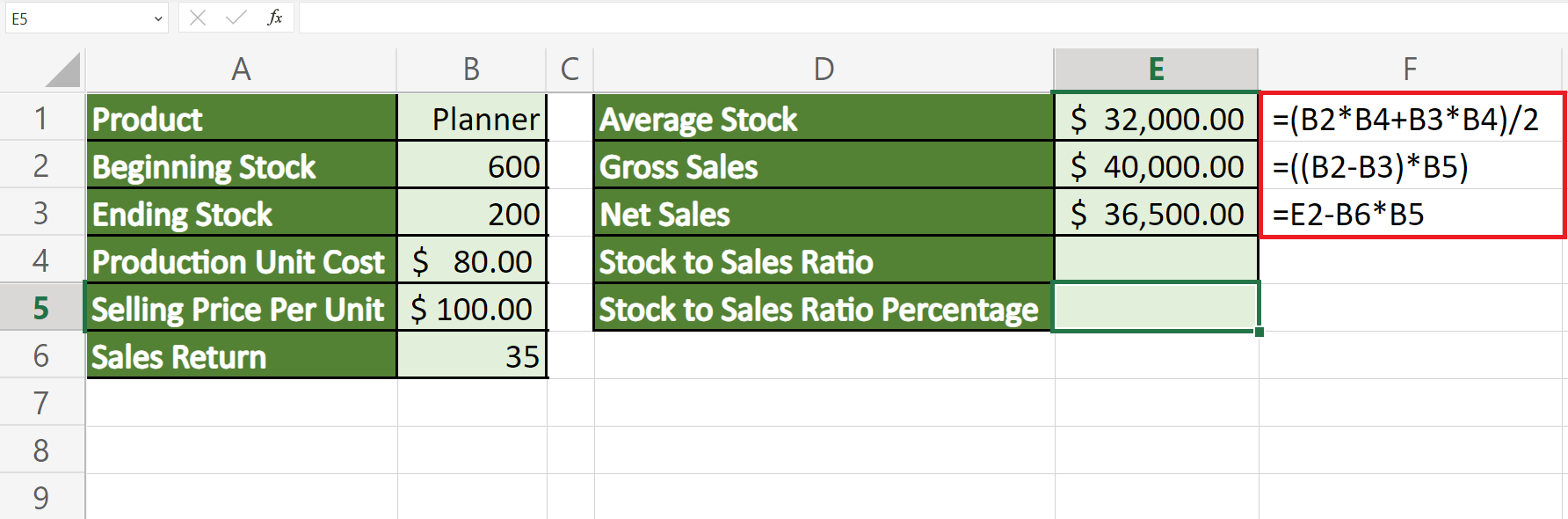

BASIC EXCEL SHEET 9 CALCULATE STOCK YouTube

The number of shares outstanding is listed in the. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity.

How to Calculate Stock to Sales Ratio in Excel Sheetaki

You will need the corporation's total stockholder equity holdings. You can learn how to find share price from balance sheets. The number of shares outstanding is listed in the. Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts.

Common Stock Price Calculator

You can learn how to find share price from balance sheets. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity. The number of shares outstanding is listed in the.

Outstanding Profit And Loss Calculator Excel Ifrs 16 Disclosure In

Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. Current stock price × number of outstanding shares = market value of equity. You will need the corporation's total stockholder equity holdings. You can learn how to find share price from balance sheets.

Common Stock Formula Calculator (Examples with Excel Template)

Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. You can learn how to find share price from balance sheets. You will need the corporation's total stockholder equity holdings.

Earnings Per Share And Other Indicators

You can learn how to find share price from balance sheets. You will need the corporation's total stockholder equity holdings. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. The number of shares outstanding is listed in the. Current stock price × number of outstanding shares = market value of equity.

6+ Common Stock Calculator ShirelleFezaan

Current stock price × number of outstanding shares = market value of equity. Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings. The number of shares outstanding is listed in the. You can learn how to find share price from balance sheets.

How to calculate stock turnover ratio form balance sheet ? How to

Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. Current stock price × number of outstanding shares = market value of equity. You will need the corporation's total stockholder equity holdings. The number of shares outstanding is listed in the. You can learn how to find share price from balance sheets.

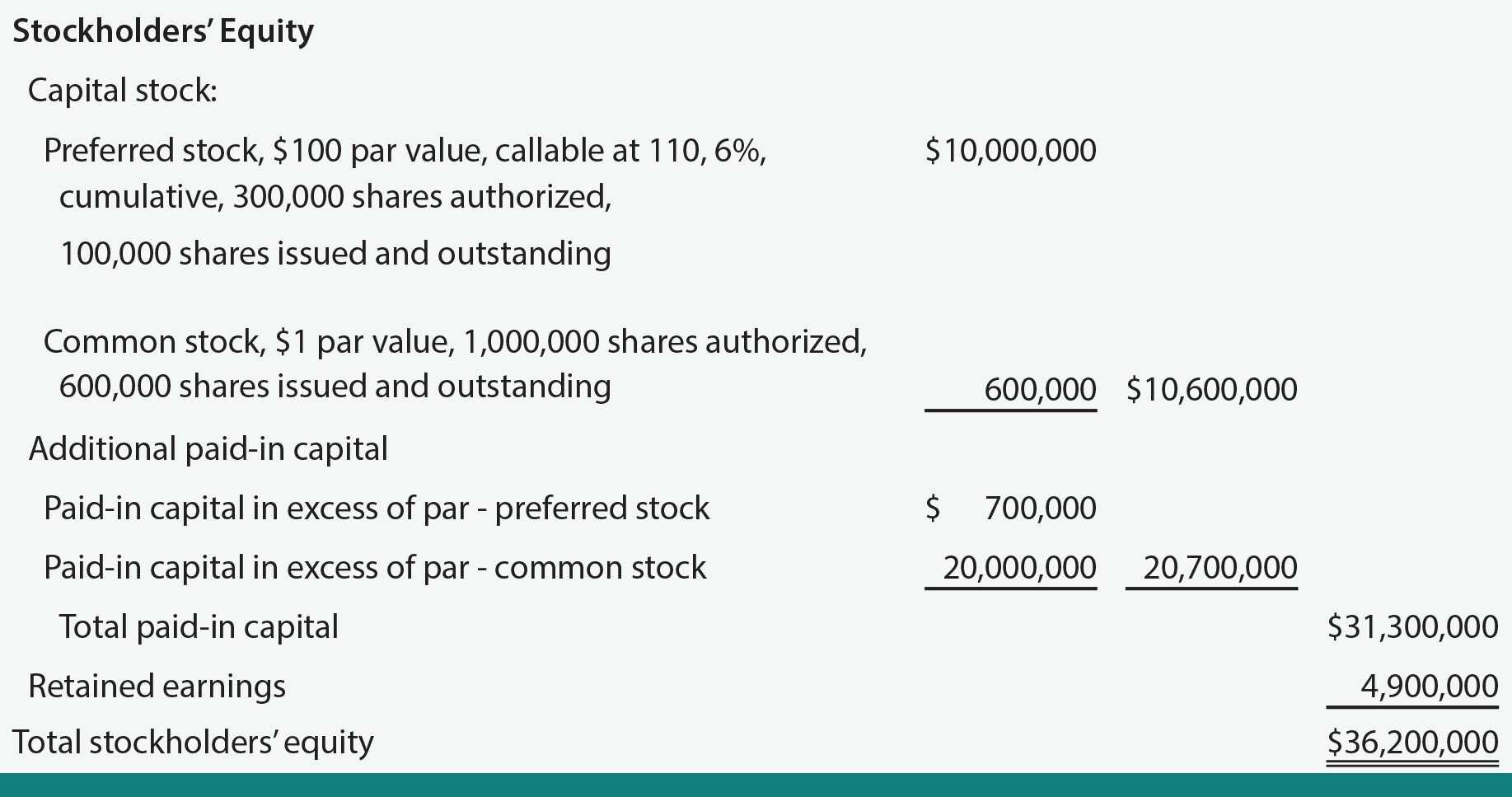

Preferred Stock On Balance Sheet sheet

Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You can learn how to find share price from balance sheets. Current stock price × number of outstanding shares = market value of equity. The number of shares outstanding is listed in the. You will need the corporation's total stockholder equity holdings.

The Number Of Shares Outstanding Is Listed In The.

Calculating the share price from a company’s balance sheet is an essential skill for investors and analysts. You will need the corporation's total stockholder equity holdings. Current stock price × number of outstanding shares = market value of equity. You can learn how to find share price from balance sheets.