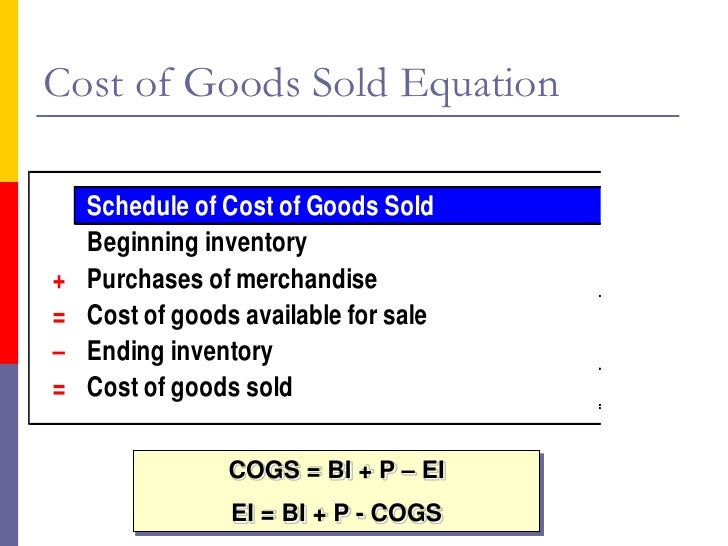

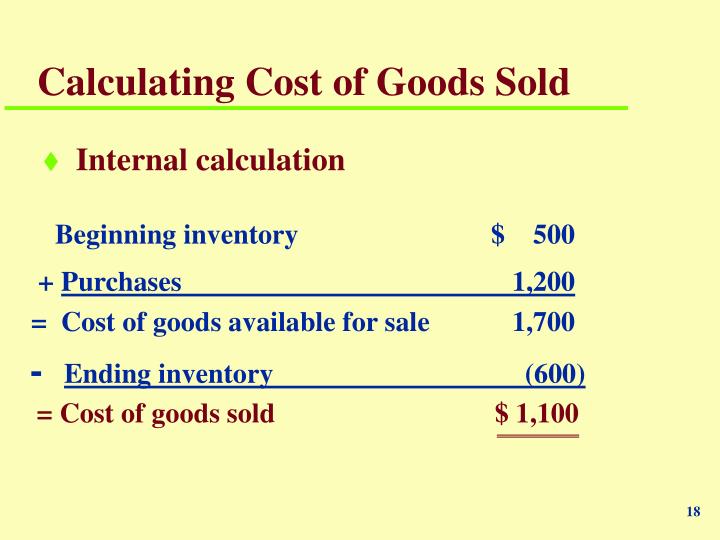

How To Find Cost Of Goods Available For Sale - Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company.

Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods.

Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods.

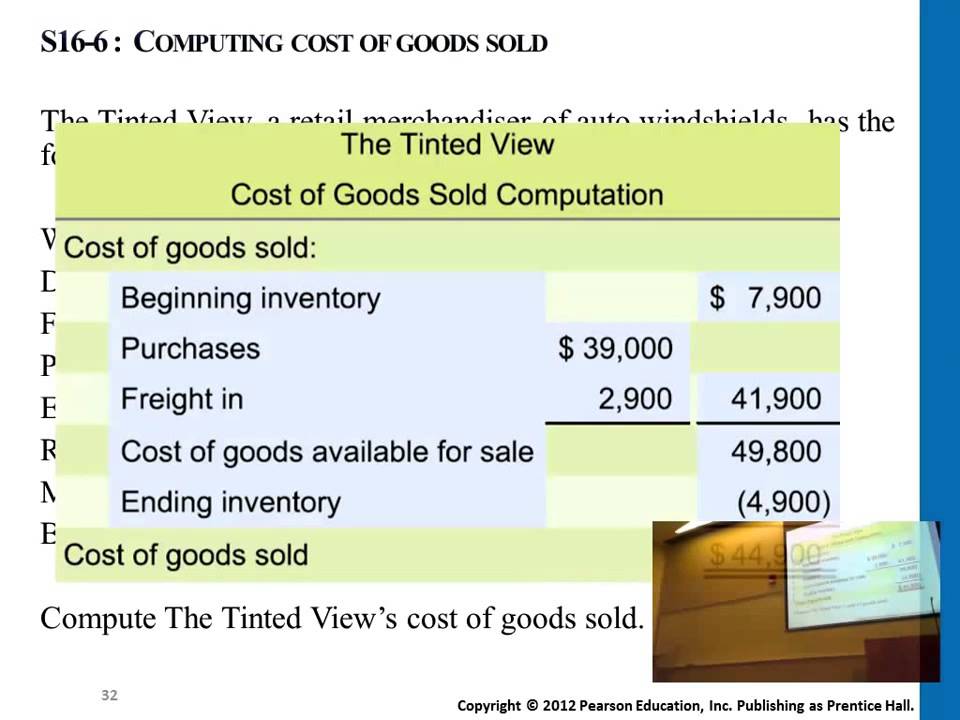

How to compute the cost of goods sold YouTube

Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn how to calculate the cost of goods available for sale, which is the total.

how to calculate cost of goods sold from statement YouTube

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. Cost of goods available for sale (cogas) = beginning inventory + purchases.

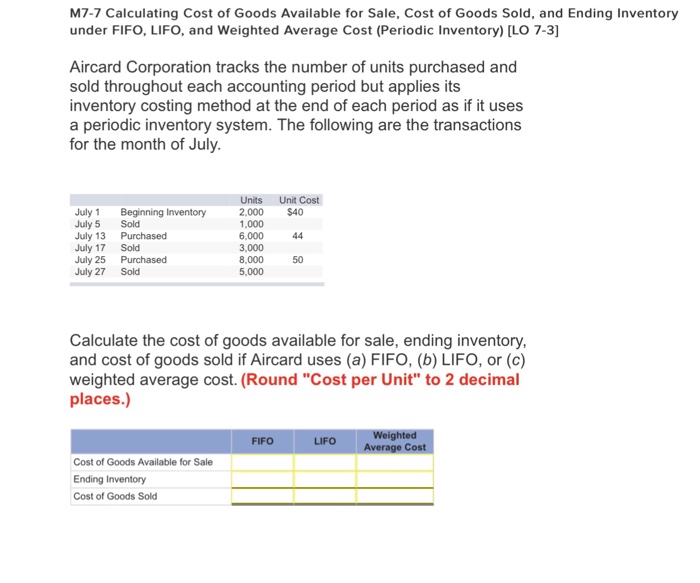

Solved M76 Calculating Cost of Goods Available for Sale,

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of.

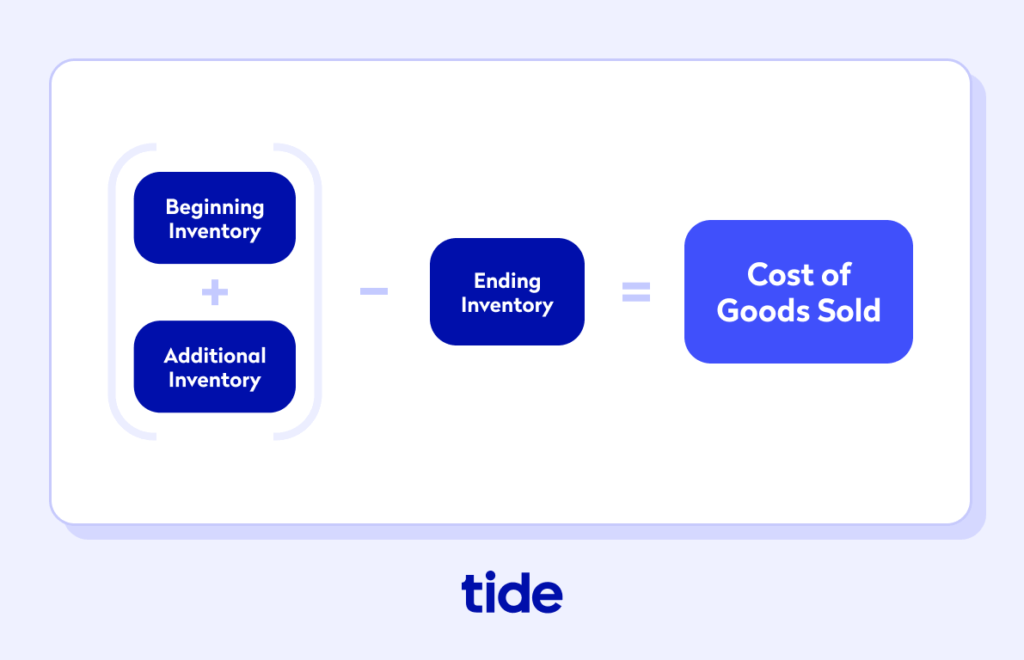

Calculating Cost of Goods Sold for Glew

Learn the components and methods of determining the cost of goods available for sale, which is the total value of inventory a company. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of.

How to calculate cost of sales (with examples provided)

Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. The calculation of the cost of goods available for sale is.

Solved Calculating Cost Of Goods Available For Sale. Cost...

Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Cost of goods available for sale (cogas) = beginning inventory + purchases.

Chapter 7

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. Learn the components and methods of determining the cost of goods available for sale, which.

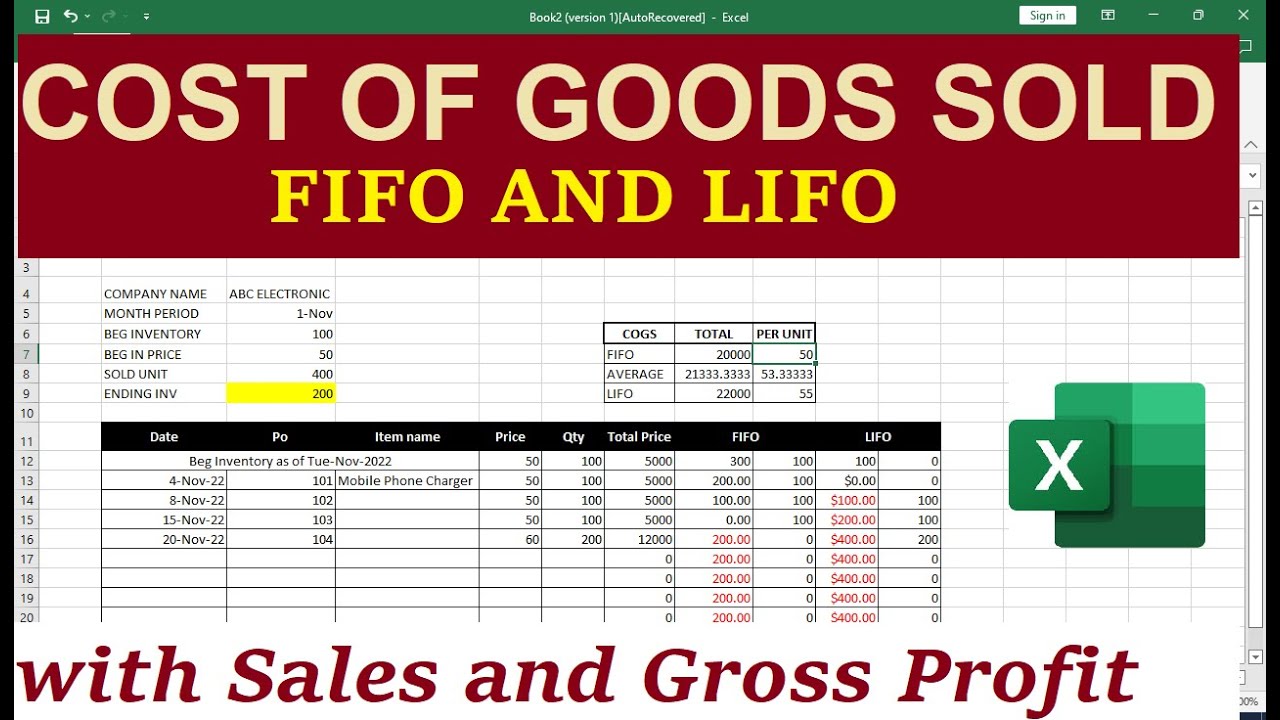

How to CALCULATE COST OF GOODS SOLD // Cost of Sales YouTube

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. Learn the components and methods of determining the cost of goods available for sale, which.

How to Calculate Cost of Goods Sold in Your Business

Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn the components and methods of determining the cost of goods available for sale, which.

PPT Chapter 7 PowerPoint Presentation ID6421395

The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period. Learn the components and methods of determining the cost of goods available.

Learn The Components And Methods Of Determining The Cost Of Goods Available For Sale, Which Is The Total Value Of Inventory A Company.

Cost of goods available for sale (cogas) = beginning inventory + purchases + cost of goods manufactured this will give you an accurate. The calculation of the cost of goods available for sale is to add together the total of beginning sellable inventory, finished goods. Learn how to calculate the cost of goods available for sale, which is the total amount your business can sell by the end of a period.