Oregon Distraint Warrant - The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. How a lien affects you assets: Instead, it is a legal document that establishes the department's right to collect. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. It also contains an injunction, or a. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. A distraint warrant states how much is owed in property tax payments and the deadline for their payment. Understand the process and implications of distraint warrants in oregon, including issuance, asset seizure, and options. At any time after issuing a warrant under this section, the department may record the warrant in the county clerk lien record of any county of. This is not a warrant for your arrest.

We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. Instead, it is a legal document that establishes the department's right to collect. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. A distraint warrant states how much is owed in property tax payments and the deadline for their payment. Understand the process and implications of distraint warrants in oregon, including issuance, asset seizure, and options. It also contains an injunction, or a. How a lien affects you assets: At any time after issuing a warrant under this section, the department may record the warrant in the county clerk lien record of any county of. This is not a warrant for your arrest.

It also contains an injunction, or a. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. At any time after issuing a warrant under this section, the department may record the warrant in the county clerk lien record of any county of. Understand the process and implications of distraint warrants in oregon, including issuance, asset seizure, and options. How a lien affects you assets: A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. Instead, it is a legal document that establishes the department's right to collect. This is not a warrant for your arrest. A distraint warrant states how much is owed in property tax payments and the deadline for their payment. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against.

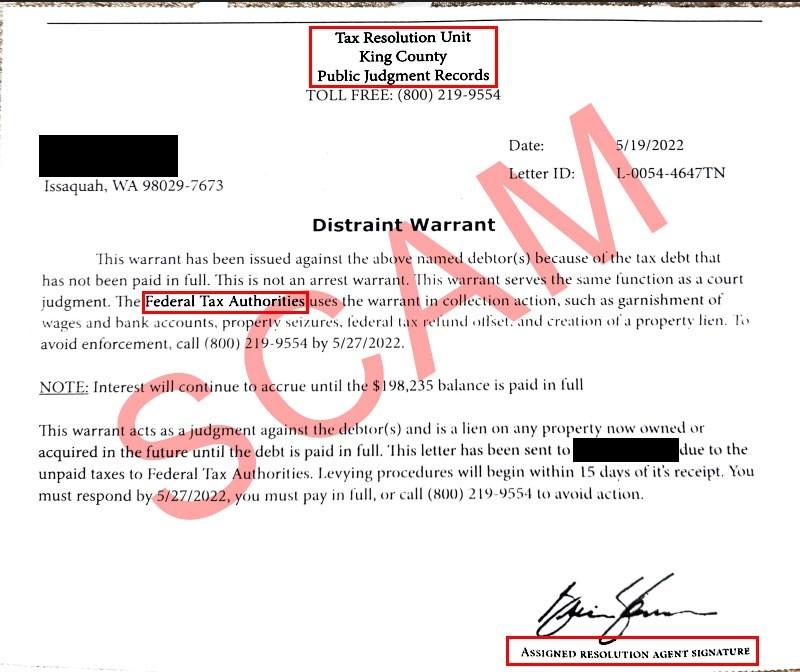

News Briefs Sheriff’s department warns of ‘distraint warrant’ tax scam

A distraint warrant states how much is owed in property tax payments and the deadline for their payment. It also contains an injunction, or a. Understand the process and implications of distraint warrants in oregon, including issuance, asset seizure, and options. At any time after issuing a warrant under this section, the department may record the warrant in the county.

Scam Alert Fraudulent Tax Letters Claiming "Distraint Warrant

A distraint warrant states how much is owed in property tax payments and the deadline for their payment. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. Understand.

Ottawa County treasurer warns of 'distraint warrant' tax scam

How a lien affects you assets: We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. Instead, it is a legal document that establishes the department's right to collect. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the.

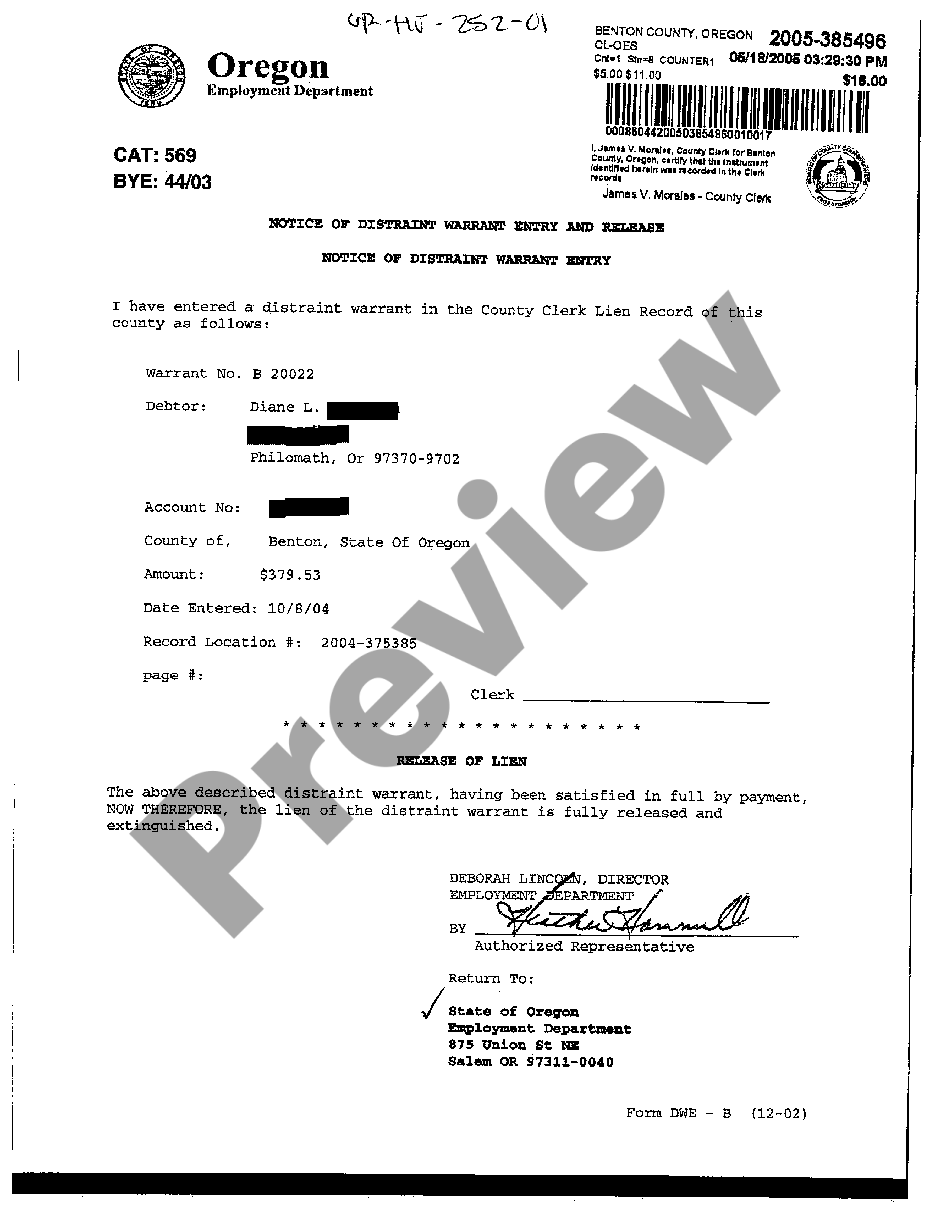

Oregon Notice of Distraint Warrant Entry and Release for an Individual

How a lien affects you assets: A distraint warrant states how much is owed in property tax payments and the deadline for their payment. Understand the process and implications of distraint warrants in oregon, including issuance, asset seizure, and options. This is not a warrant for your arrest. It also contains an injunction, or a.

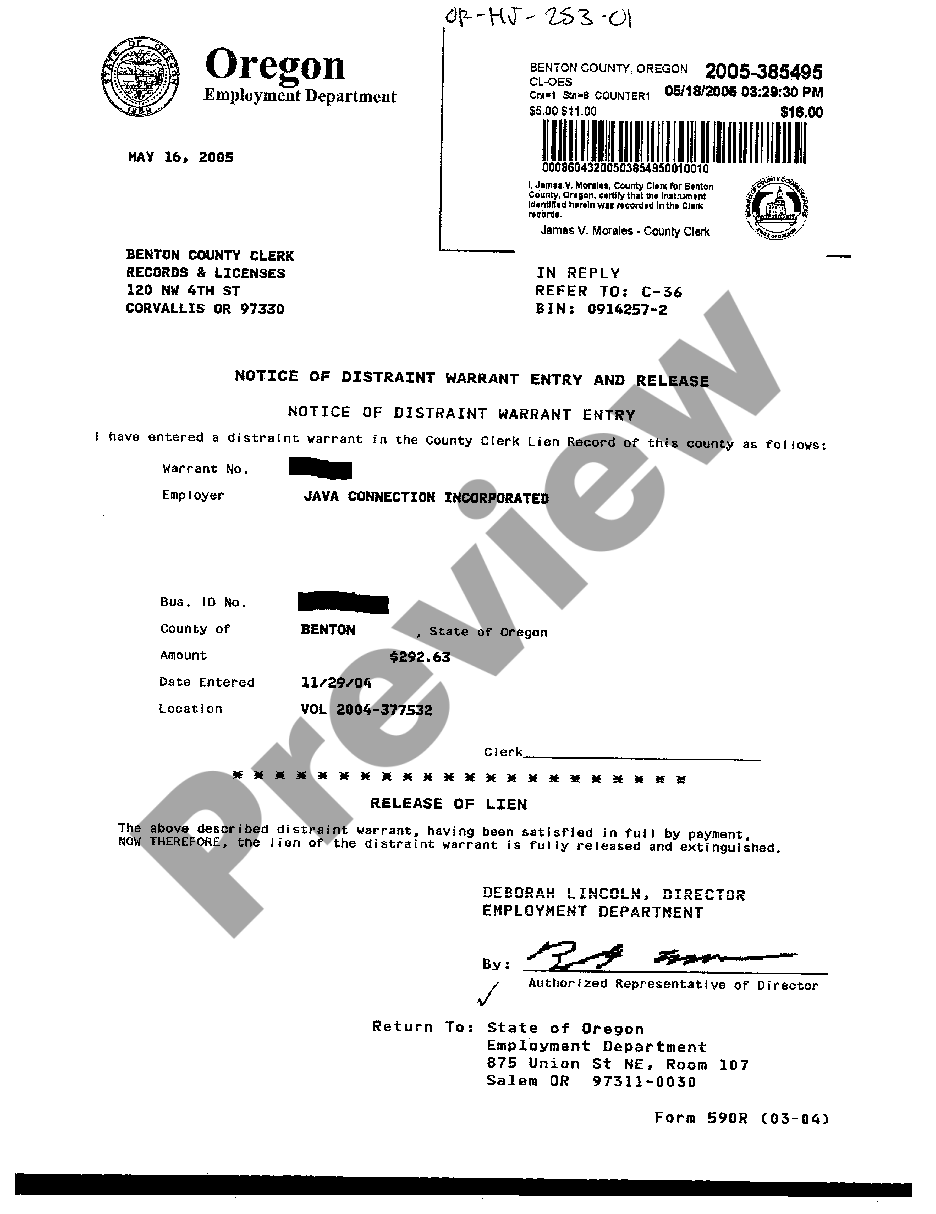

Oregon Notice of Distraint Warrant Entry and Release for a Corporation

It also contains an injunction, or a. At any time after issuing a warrant under this section, the department may record the warrant in the county clerk lien record of any county of. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. How a lien affects you assets: A warrant need not be.

Judgement Records Search

This is not a warrant for your arrest. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. A distraint warrant states how much is owed in property tax payments and the deadline for their payment. Understand the process and implications of distraint.

SSS Guideline On The Warrants of Distraint Levy and or Garnishment PDF

Instead, it is a legal document that establishes the department's right to collect. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. A distraint warrant states.

Distraint warrant Fill out & sign online DocHub

The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. It also contains an injunction, or a. A distraint warrant states how much is owed in property.

Distraint Warrant Summary Constitutional Law 2 Studocu

This is not a warrant for your arrest. How a lien affects you assets: It also contains an injunction, or a. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the.

Fake tax letter sent to Winnebago County residents, officials warn

We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. How a lien affects you assets: This is not a warrant for your arrest. The amount of the distraint.

Understand The Process And Implications Of Distraint Warrants In Oregon, Including Issuance, Asset Seizure, And Options.

This is not a warrant for your arrest. A warrant need not be recorded in the county clerk lien record as a condition of issuing a notice of garnishment under the provisions of. At any time after issuing a warrant under this section, the department may record the warrant in the county clerk lien record of any county of. How a lien affects you assets:

Instead, It Is A Legal Document That Establishes The Department's Right To Collect.

A distraint warrant states how much is owed in property tax payments and the deadline for their payment. We issue state tax liens after we’ve issued a distraint warrant and the balance remains unpaid. The amount of the distraint warrant shall become a lien upon the title to and interest in any property owned or later acquired by the debtor against. It also contains an injunction, or a.