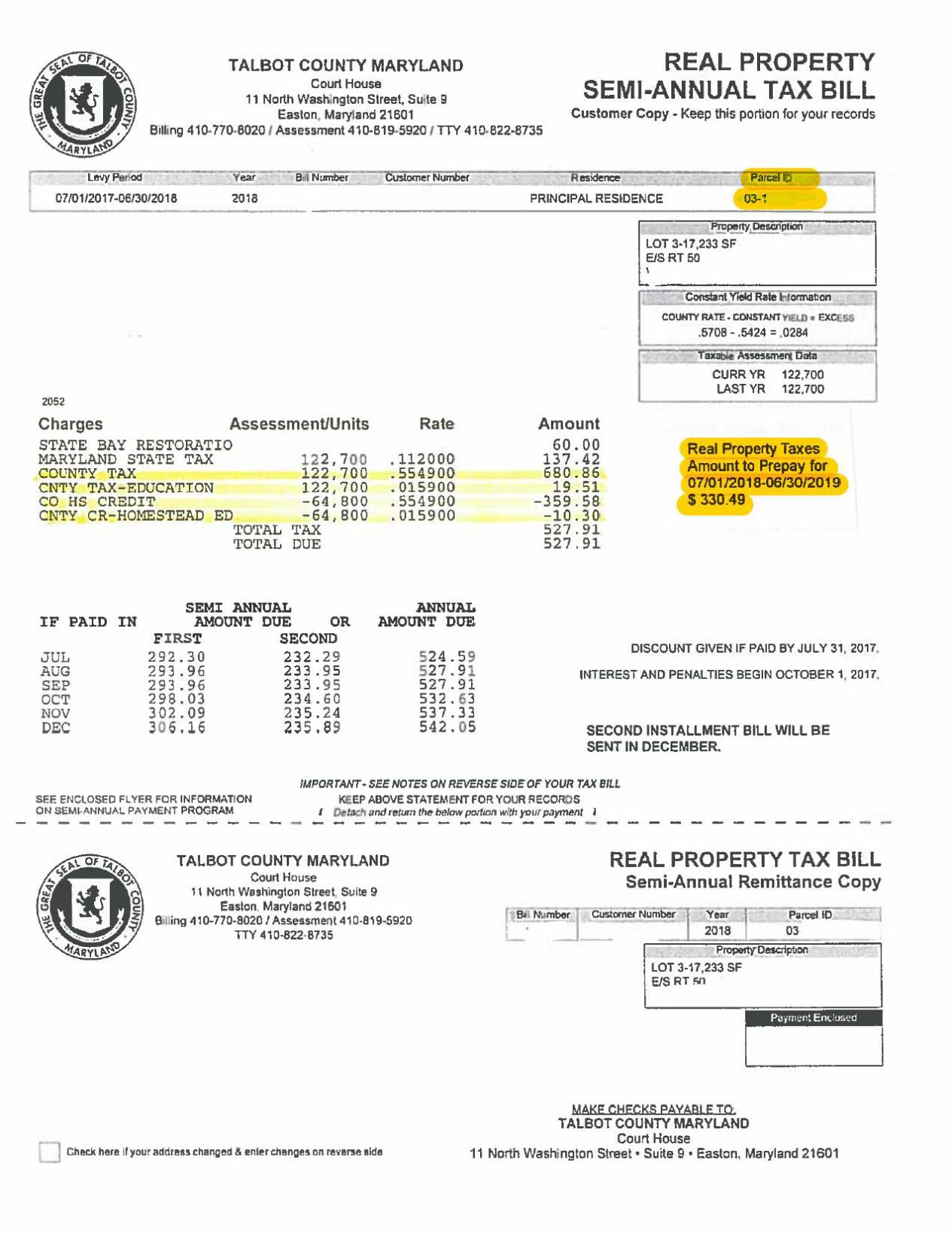

Recent Tax Bill - The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

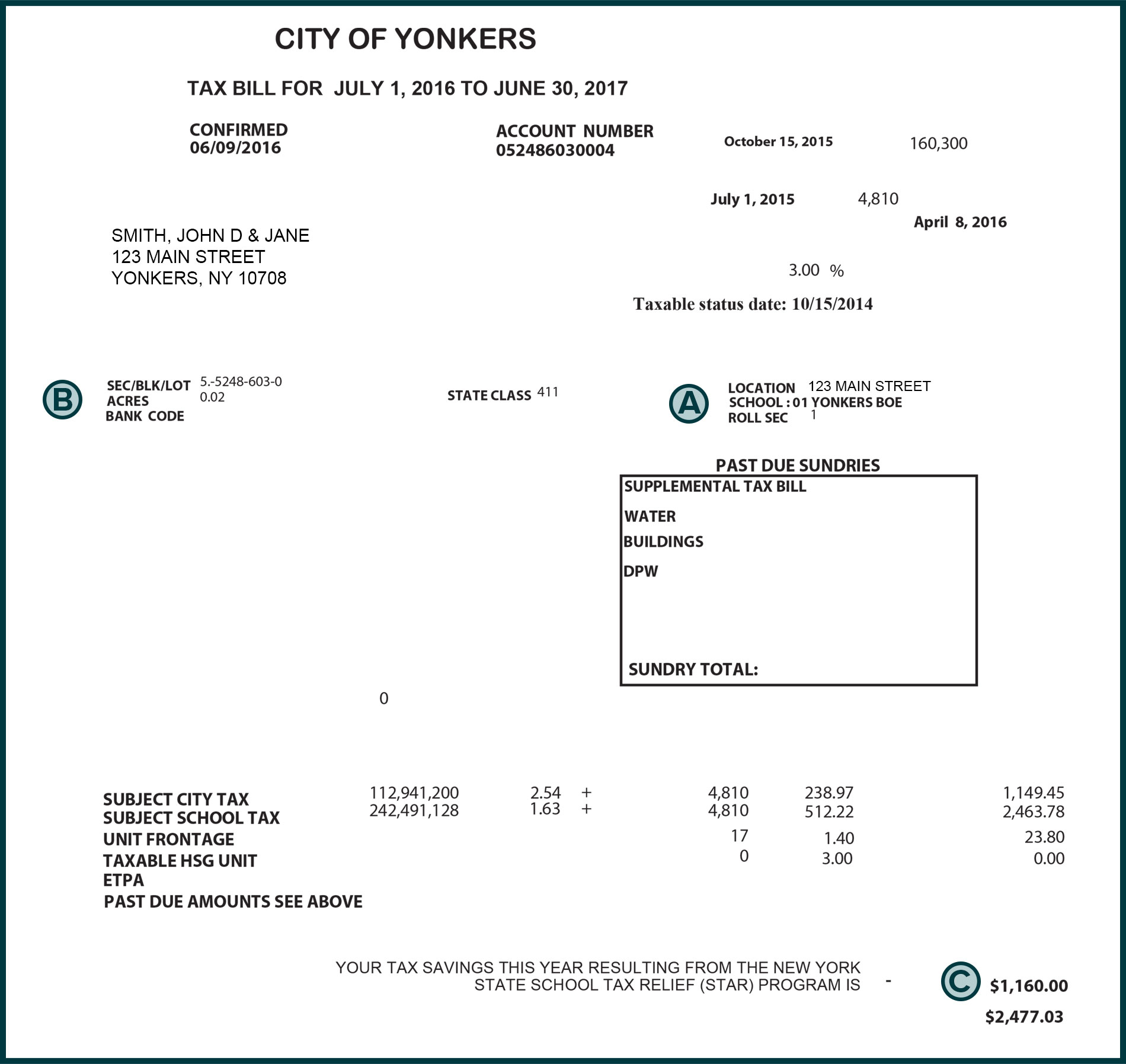

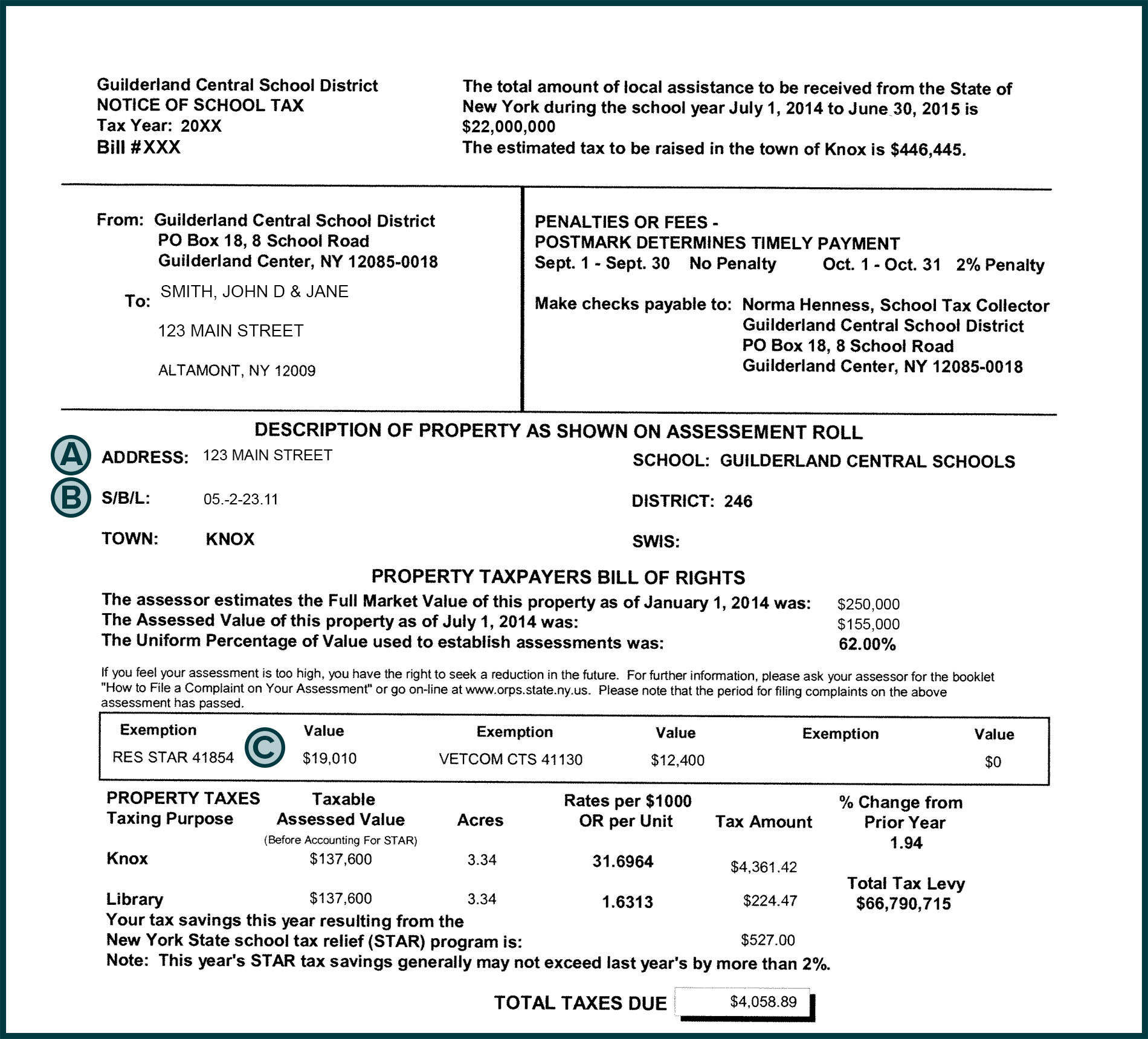

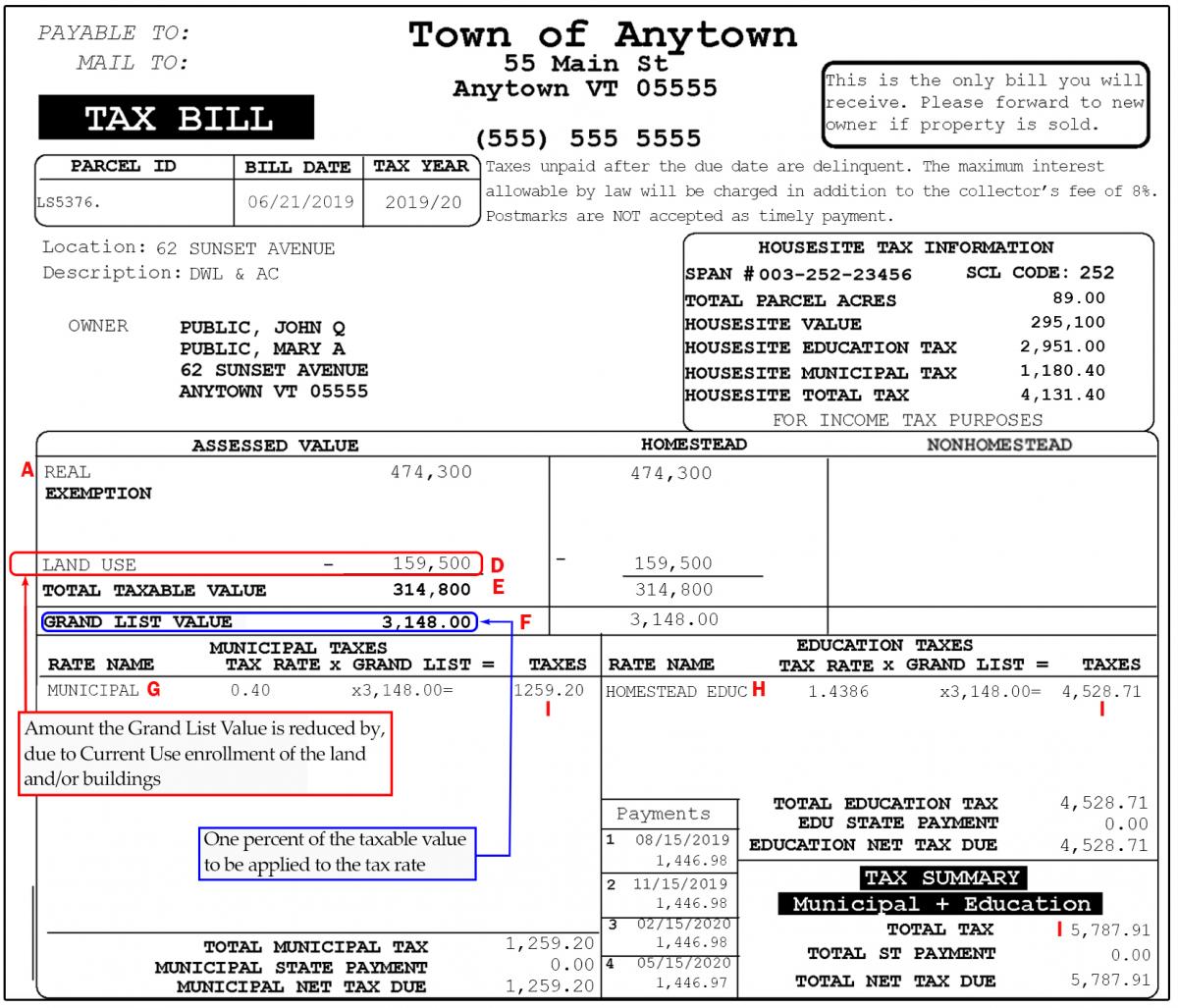

Sample Tax Bill

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

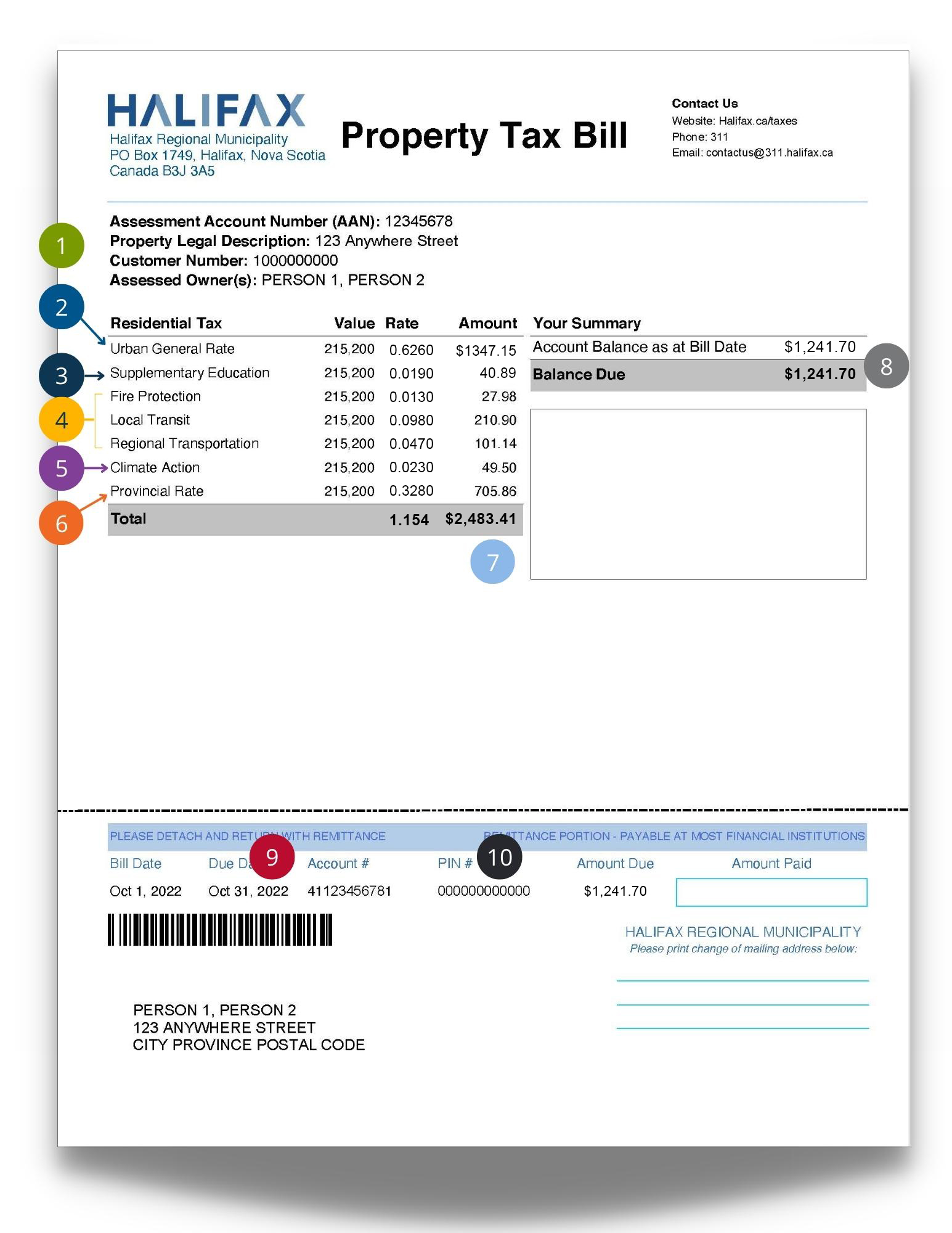

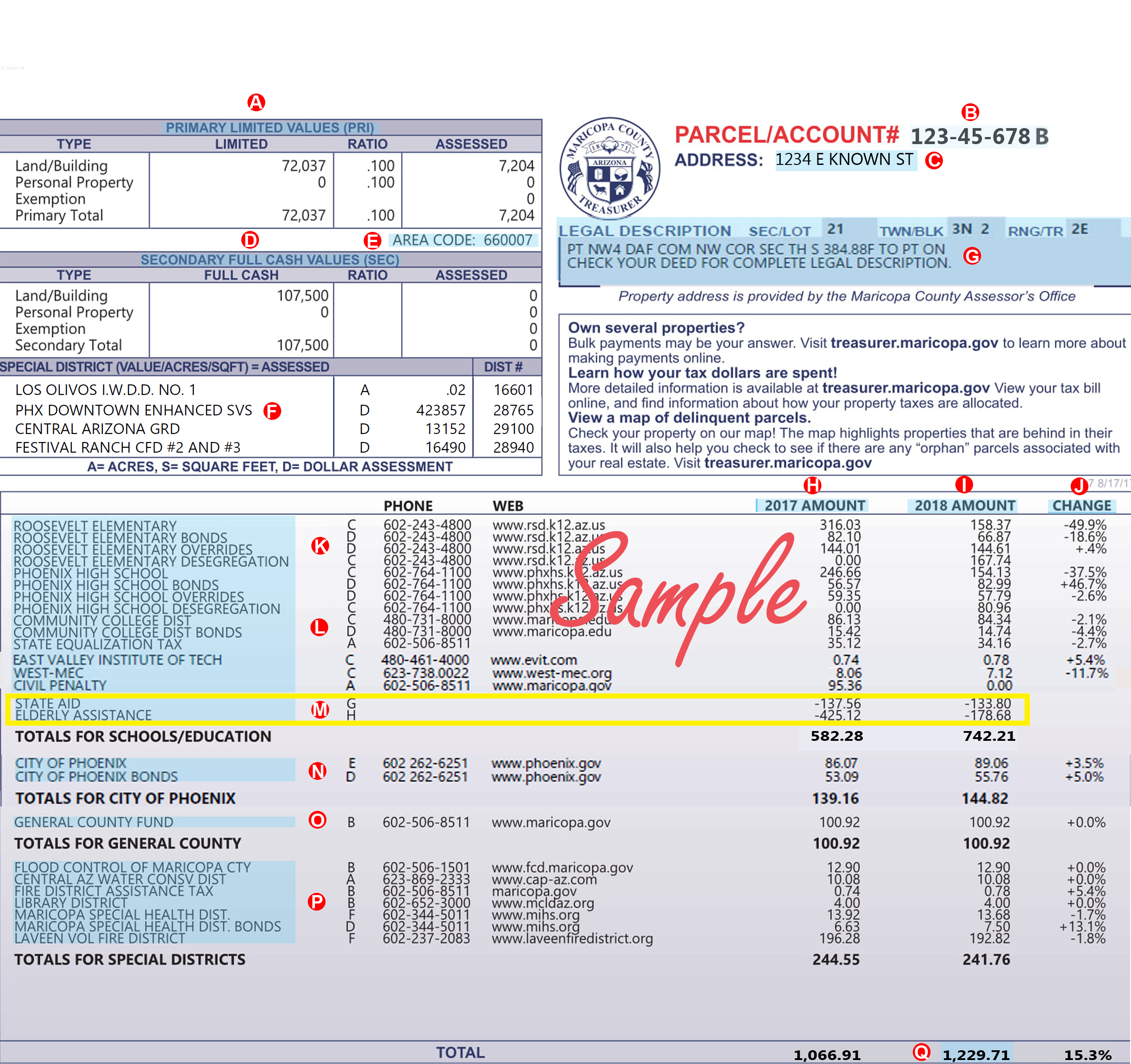

Property tax bill examples

To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe. The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average.

Here’s What You Need to Know About the New Tax Bill

To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe. The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average.

Property tax bill examples

To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe. The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average.

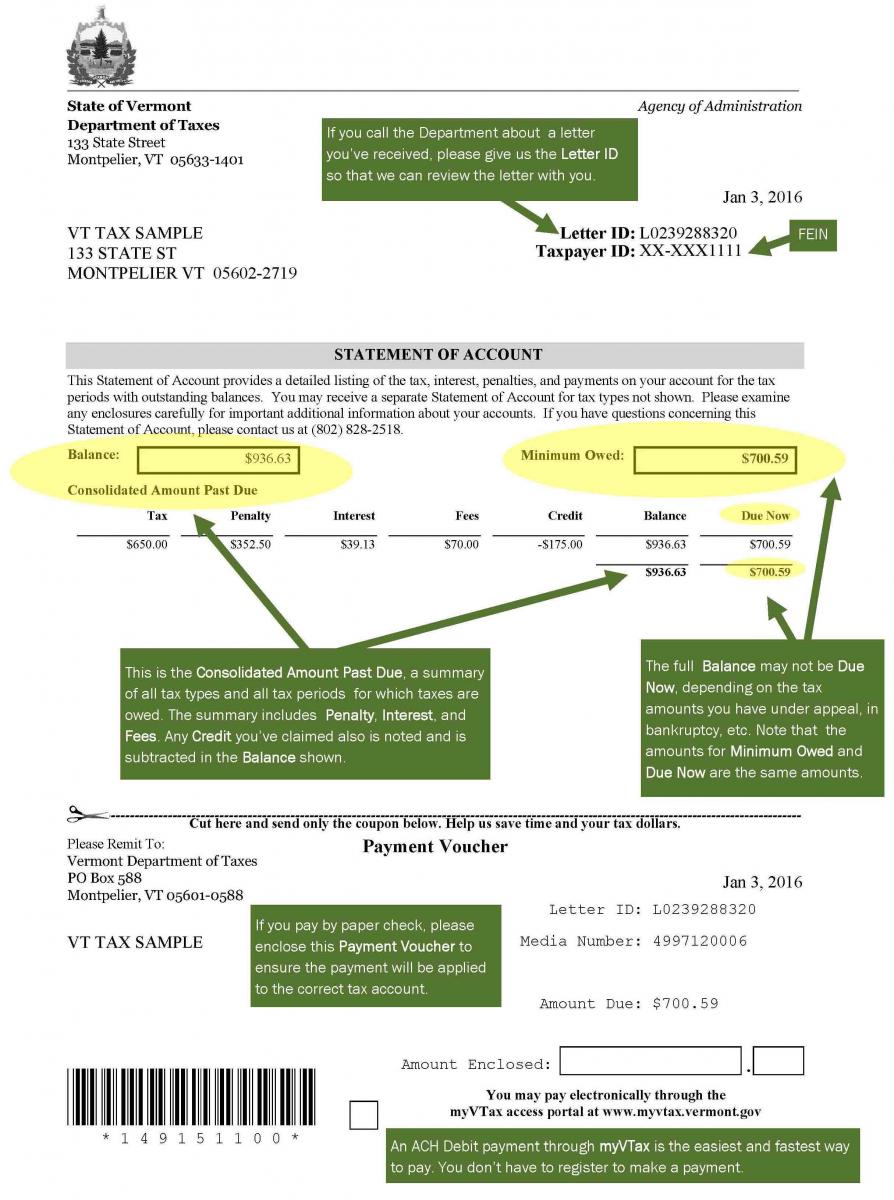

Understanding Your Tax Bill Department of Taxes

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

Help still available for paying property tax bills in Mecklenburg

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

Current Use and Your Property Tax Bill Department of Taxes

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

How to read your tax bill Property taxes Taxes Halifax

To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe. The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average.

New Tax Bill From April 1? Big Changes Coming Are You Ready

The next group, with incomes between $17,000 and $51,000, would lose $430 in income, or 1.1%, on average. To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.

The Next Group, With Incomes Between $17,000 And $51,000, Would Lose $430 In Income, Or 1.1%, On Average.

To partially offset the lost revenue, republicans propose repealing or phasing out more quickly the clean energy tax credits passed during joe.