Tax Warrant Indiana - Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. The process begins when a taxpayer fails. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. Find out the consequences, payment. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at.

Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. The process begins when a taxpayer fails. Find out the consequences, payment.

The process begins when a taxpayer fails. Find out the consequences, payment. Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online.

Indiana Department Of Revenue Tax Warrants

Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. Find out the consequences, payment. The process begins when a taxpayer fails. In indiana, tax warrants are issued based on specific.

Tax Warrants — DeKalb County Sheriff's Office

Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. Learn how to avoid or resolve.

pay indiana tax warrant online Reyes Ralph

Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. The process begins when a taxpayer fails. Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's.

pay indiana tax warrant online Reyes Ralph

The process begins when a taxpayer fails. Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. In indiana, tax warrants are issued based on specific legal criteria in the indiana.

indiana department of revenue tax warrants Sanda Gerald

Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. Find out the consequences, payment. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. If.

Doxpop Tools for Attorneys and Public Information Researchers NEW

If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. Find out the consequences, payment. The process begins when a taxpayer fails. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. Learn how to avoid or resolve a tax warrant for collection of tax.

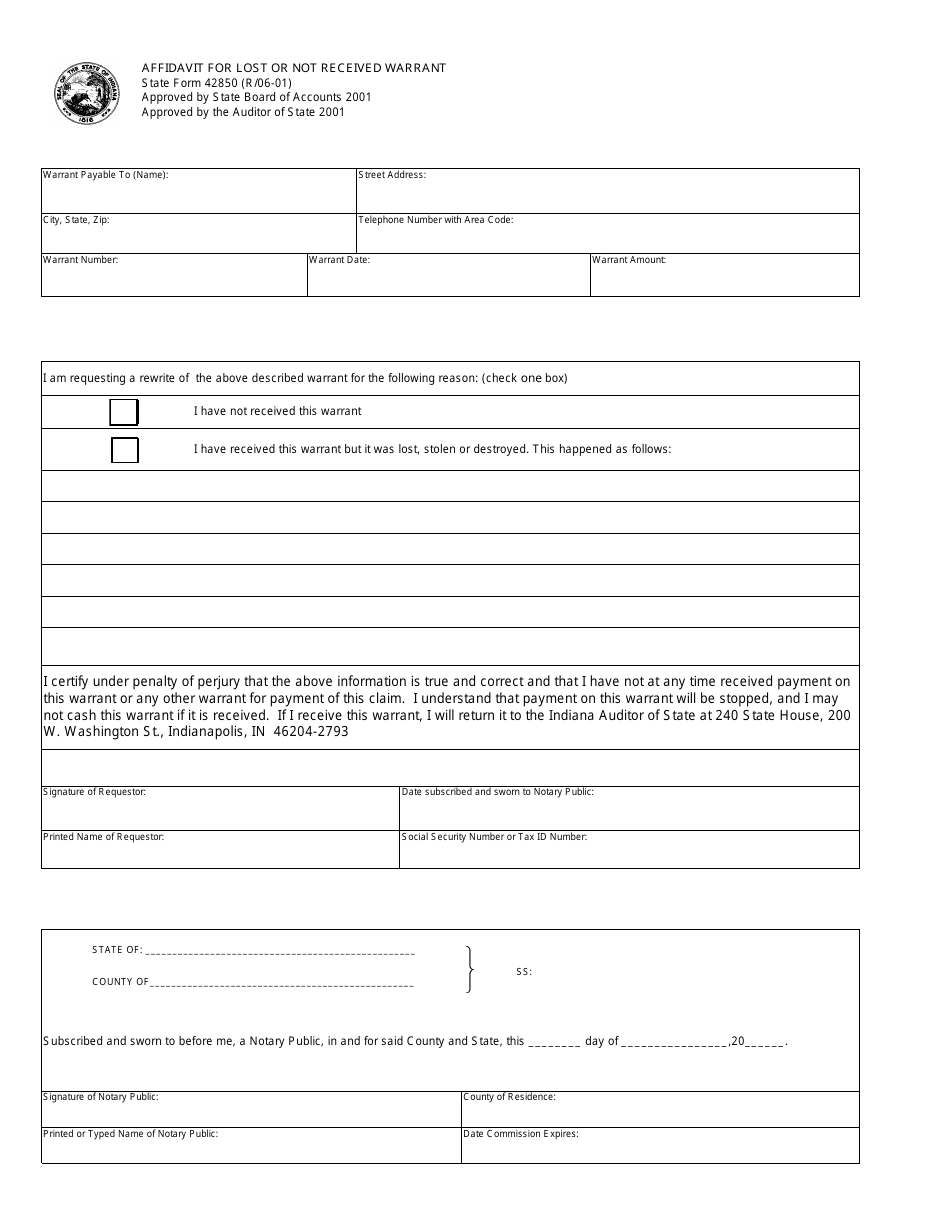

SBOA Library Resource County Auditors

The process begins when a taxpayer fails. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. Find out the consequences, payment. Learn how to exchange tax warrants electronically between the state of indiana and.

pay indiana tax warrant online Reyes Ralph

The process begins when a taxpayer fails. Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. In indiana, tax warrants are issued based on specific legal criteria in the indiana code. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments.

Indiana Department Of Revenue Tax Warrants

If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. Find out the consequences, payment. The process begins when a taxpayer fails. Learn how to avoid or resolve a tax warrant.

pay indiana tax warrant online Reyes Ralph

In indiana, tax warrants are issued based on specific legal criteria in the indiana code. Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. The process begins when a taxpayer fails. Find out the consequences, payment. If you have questions concerning your taxes or disagree with the amount owed, contact.

In Indiana, Tax Warrants Are Issued Based On Specific Legal Criteria In The Indiana Code.

Learn how to exchange tax warrants electronically between the state of indiana and county offices, and make payments online. Learn how to avoid or resolve a tax warrant for collection of tax filed by dor with county clerk's offices. Find out the consequences, payment. If you have questions concerning your taxes or disagree with the amount owed, contact the indiana department of revenue at.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)