When Are Hsa Tax Forms Available - Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be found in your online account starting january 31. Refer to your w2 for hsa contributions. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements.

Hsa tax forms can be found in your online account starting january 31. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Refer to your w2 for hsa contributions. Healthequity provides the health savings account (hsa) tax.

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Hsa tax forms can be found in your online account starting january 31. Refer to your w2 for hsa contributions. Healthequity provides the health savings account (hsa) tax.

HSA, Health Savings Account, and Tax Forms. Editorial Photo

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be found in your online account starting january 31. The irs does not require separate hsa tax forms because the information related to your hsa.

HSA Edge

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be found in your online account starting january 31. Refer to your w2 for hsa contributions. Health savings accounts (hsas) offer tax advantages for medical.

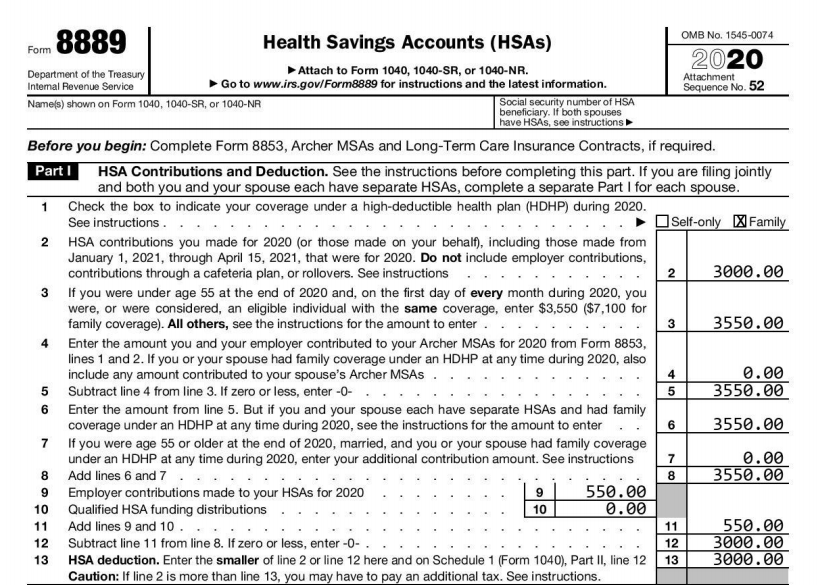

Hsa Savings Account Form

Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Refer to your w2 for hsa contributions. The irs does not require separate hsa tax forms.

2023 Hsa Form Printable Forms Free Online

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Hsa tax forms can be found in your online account starting january 31. Healthequity provides the health savings account (hsa) tax. Refer to your w2 for hsa contributions. Health savings accounts (hsas) offer tax advantages for medical.

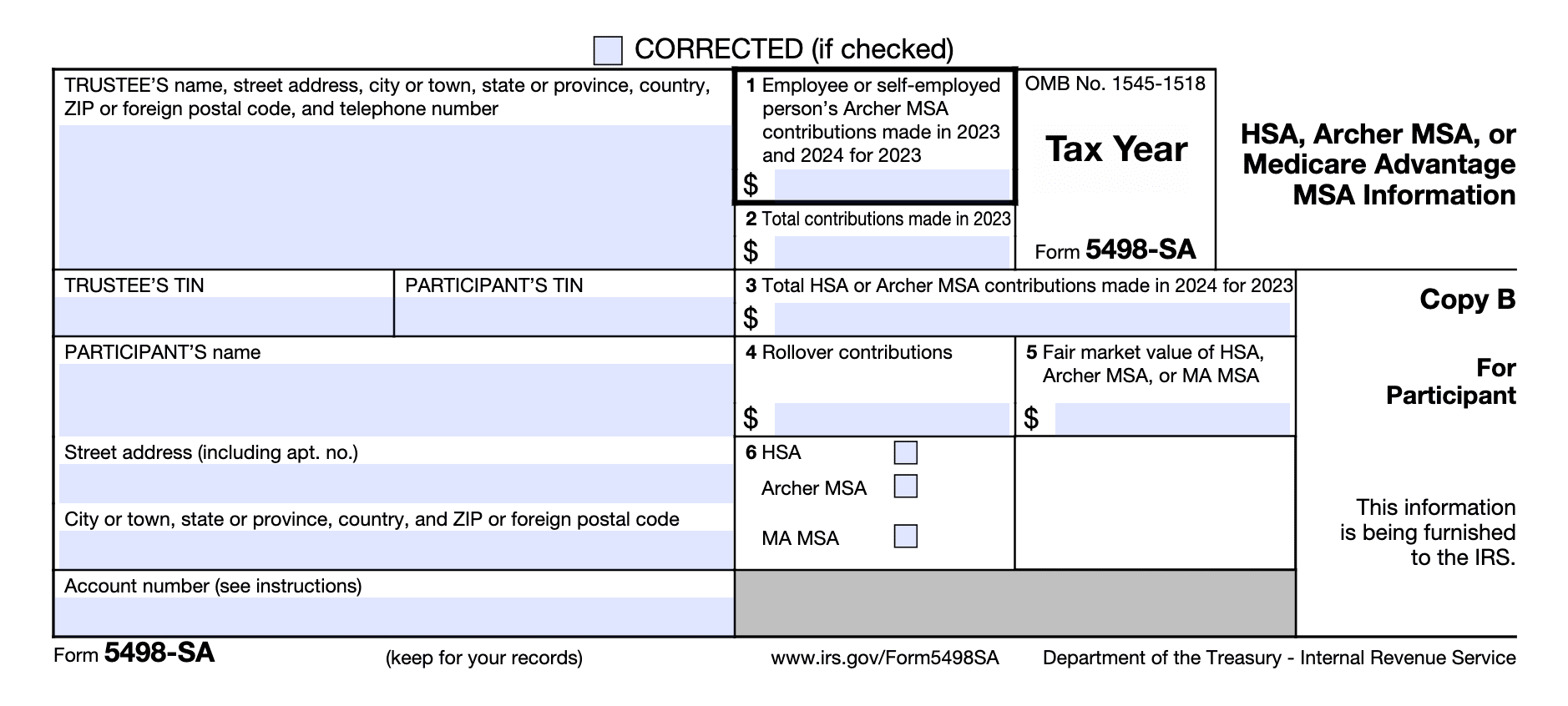

Fillable Online Form 5498, Form 1099, Form 8889 HSA Tax Forms

Hsa tax forms can be found in your online account starting january 31. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Refer to your w2 for hsa contributions. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form.

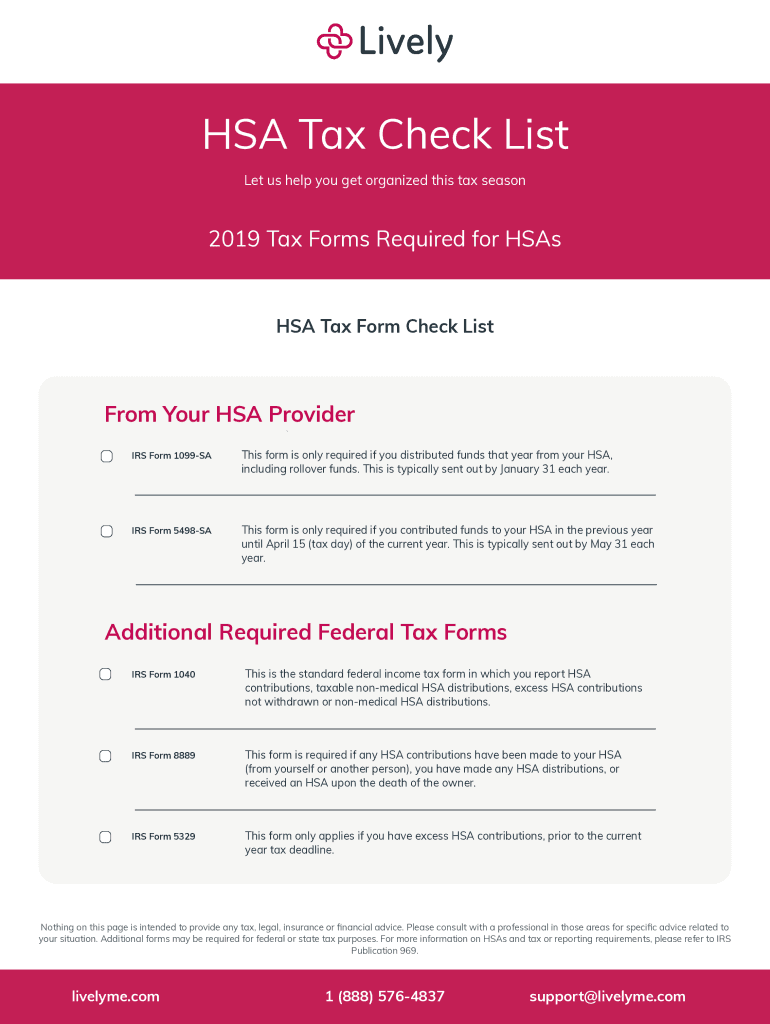

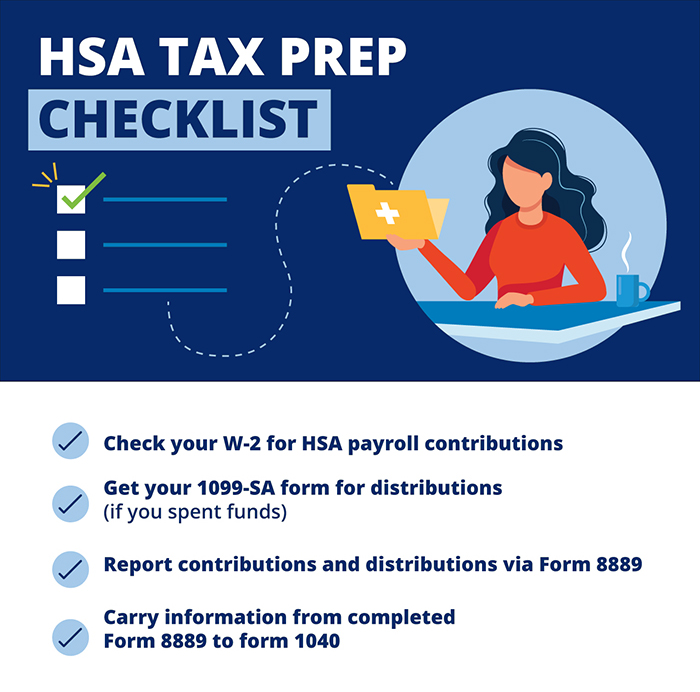

4 Important Tips About Tax Returns & HSAs First American Bank

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account (hsa) tax. Refer to your w2 for.

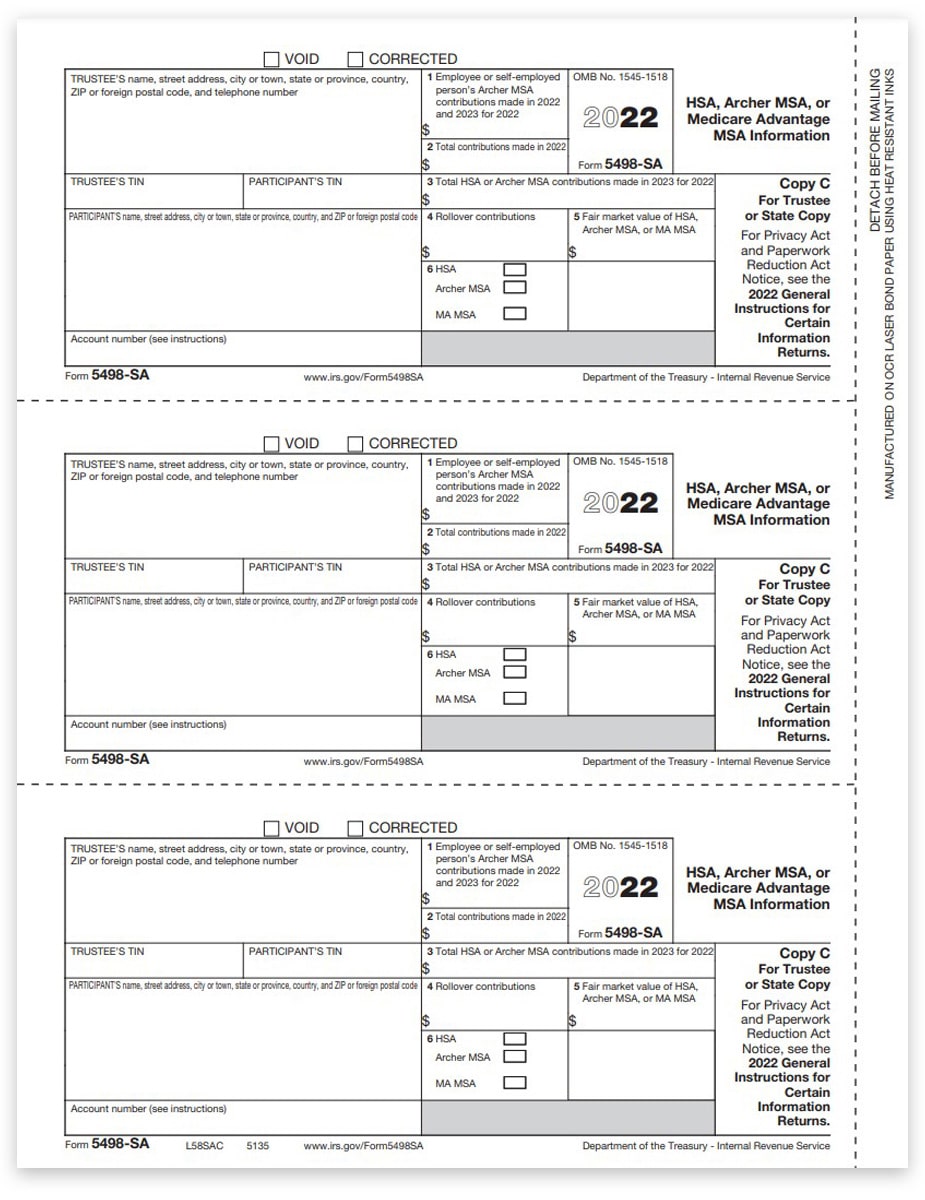

IRS Form 5498SA walkthrough (HSA, Archer MSA, or Medicare Advantage

Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Refer to your w2 for hsa contributions..

How To Quickly (And TaxEfficiently) Draw Down HSA Assets

Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Healthequity provides the health savings account (hsa) tax. Hsa tax forms can be.

How HSA Distributions and Contributions Affect Your Tax Return

The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Healthequity provides the health savings account (hsa) tax. Health savings accounts (hsas) offer.

Fillable Online HSA and Tax Forms

The irs does not require separate hsa tax forms because the information related to your hsa activity is already captured on your form 8889,. Refer to your w2 for hsa contributions. Hsa tax forms can be found in your online account starting january 31. Each year you contribute to or make withdrawals from your health savings account, you'll need to.

The Irs Does Not Require Separate Hsa Tax Forms Because The Information Related To Your Hsa Activity Is Already Captured On Your Form 8889,.

Healthequity provides the health savings account (hsa) tax. Each year you contribute to or make withdrawals from your health savings account, you'll need to fill out form 8889, the hsa tax. Refer to your w2 for hsa contributions. Health savings accounts (hsas) offer tax advantages for medical expenses but come with specific tax reporting requirements.